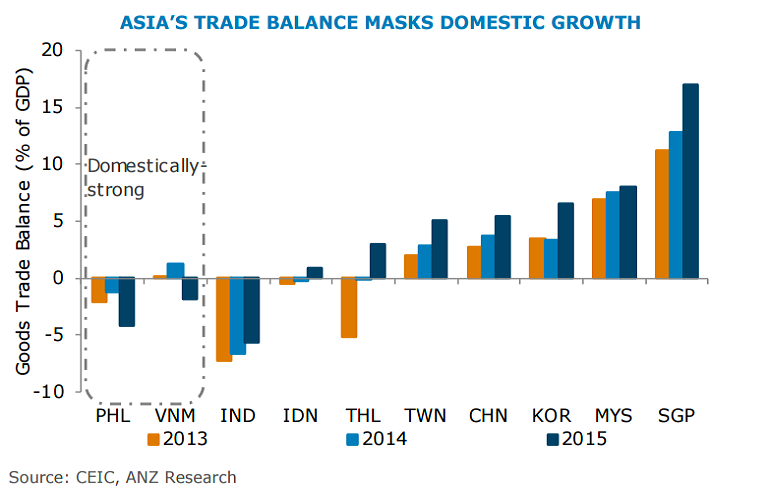

Trade recession continues in Asia and has varying effects on the region’s trade balance. Despite the persistent contraction in exports, the broadly expected deterioration in Asian countries' trade balance has not occurred. For most countries, import contractions outstripped export declines. The resilience in trade balance reflects the relative strength of domestic activity.

In most Asian countries contraction in exports continues for the second year running, reflecting the weakness in final demand. Apart from exports, the strength of domestic demand and the share of domestically-related imports will determine whether trade balances will improve or deteriorate. Countries with relatively soft domestic demand saw improvements in their trade balance, while those with resilient domestic demand posted deterioration as imports continued to rise despite soft exports.

Q2 GDP numbers in many countries indicate that the contribution of net exports has not been as negative as expected. Details of surveys show a high share of private consumption to GDP. While this is necessary, it is not a sufficient condition to keep import growth afloat. Fiscal support from authorities will likely allow import growth to gain traction through 2017. If the export outlook remains weak, the trade balance could deteriorate.

Singapore and South Korea to have soft domestic demand and risks are increasingly tilted towards extended weakness in the coming months. As for Vietnam, domestic demand is still on the path to recovery. In the middle of the spectrum in terms of sluggish domestic activity but with improving medium-term outlook are China, India, Indonesia, Malaysia, Taiwan, and Thailand.

"Looking forward, we expect fiscal multipliers to be activated in support of domestic demand. While some countries have posted sluggish domestic activity, and consequently weak import growth, fiscal support should allow import growth to gain traction through 2017," said ANZ Research in a report.

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record