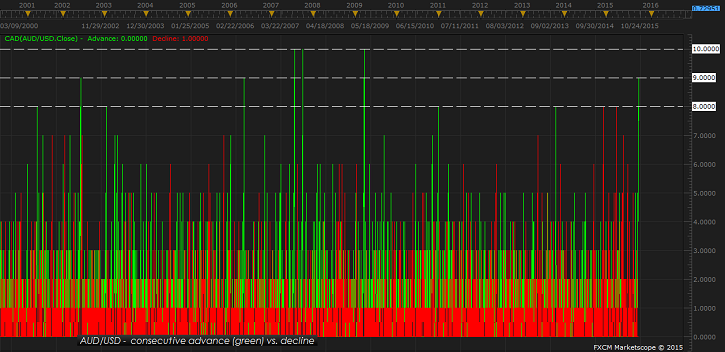

Australian Dollar has taken a back seat today, after its longest winning streak since 2009, as it advanced for past 9 days covering more than 350 pips gain against Dollar.

Today Chinese trade data which showed, China's record surplus in Renminbi came in the back of -17.7% yearly basis drop in imports in September. Trade surplus was 60.34 billion in September in US Dollar term.

Recent rise in commodity currencies came in the back of recovery in commodity prices as well as push back in rate hike expectations from FED well into next year after weaker job gains in September. However, hard commodities haven't recovered like the soft ones in this recent rise.

Australian Dollar has reached its immediate target around 0.735 against Dollar, further gains would demand larger conviction over commodity recovery as well as broad based weakness in US Dollar.

So if Aussie closes below previous day low (PDL) at 0.736, larger drawdown might be on card.

Aussie is currently trading at 0.729 against Dollar.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings