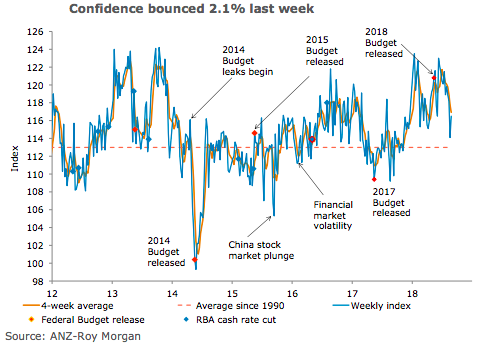

Australia’s ANZ-Roy Morgan weekly consumer confidence bounced 2.1 percent last week, following a sharp 3.5 percent decline in the prior week. The details were positive, with all but one sub-index posting gains. Households’ perception of current financial conditions improved 1.2 percent last week, largely. recovering from the 1.3 percent fall in the previous week.

Sentiment towards future financial conditions bounced a solid 3.1 percent, partially reversing the 7.6 percent tumble in the week prior. Consumers’ were also more optimistic about current economic conditions – their assessment improved 2.9 percent last week, ending its streak of weekly declines.

Of particular note, views towards future economic conditions jumped 6.1 percent- more than reversing the previous week’s 5.3 percent decline and bringing the sub-index to its highest value in six weeks. Going against the tide, the ‘time to buy a household item’ sub-index slipped 2.2 percent to 126.5 (vs 134.0 long term average). Four-week moving average inflation expectations were unchanged at 4.3 percent.

"The strong recovery in future economic conditions suggests that households may view the result as providing policy continuity. It is not all good news, however. Despite the tick up in headline confidence, households remain pessimistic about purchasing large household items. This sub-index has fallen sharply from its recent high in June, and now sits well below its long term average. Sluggish wage growth, high levels of debt and decreasing house prices are likely constraining sentiment in this regard," said David Plank, Head of Australian Economics, ANZ Research.

Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock