Australia recorded A strong CAPEX report overall. The Q2 activity came in ahead of expectations, with a solid plant and equipment spending, which will contribute to Q2 GDP. The outlook for 2017-18 investment was also revised upward. Solid reported business conditions appear to be supporting the transition away from the mining sector, with a number of services industries the key beneficiaries.

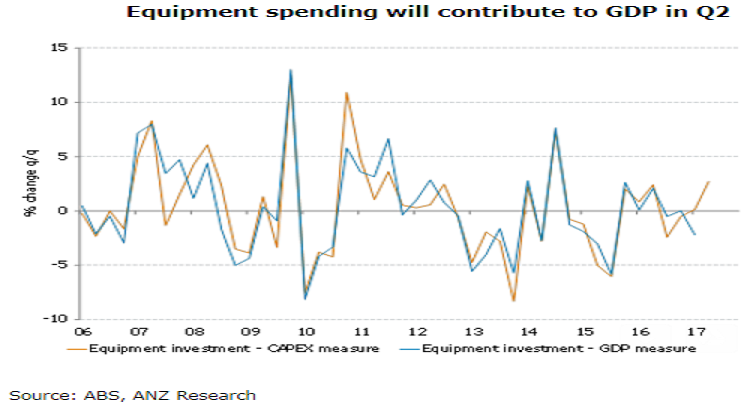

CAPEX recorded a better-than-expected 0.8 percent q/q rise in Q2 (as well as an upwardly revised 0.9 percent q/q rise in Q1). Importantly, spending on plant and equipment (which flows directly into GDP) posted the strongest result in nearly three years, with a growth of 2.7 percent q/q. This positive result is in line with improved business conditions and capacity utilization in recent months and will support next week’s GDP result.

Further, the outlook for spending through 2017-18 was revised significantly higher. This was driven by the non-mining sector, with the reported estimate of AUD69.7 billion implying that spending will rise by 8.3 percent y/y. This encouraging result is a welcome change from the past two years of stagnation and suggests that the aforementioned strength in reported conditions is now flowing through to actual investment plans.

Much of this growth is expected to come from the services sectors. IT, media and telecommunications; finance and insurance; rental, hiring and real estate; and professional, scientific and technical services are all reporting expectations of double-digit investment growth over the next year.

Meanwhile, FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals