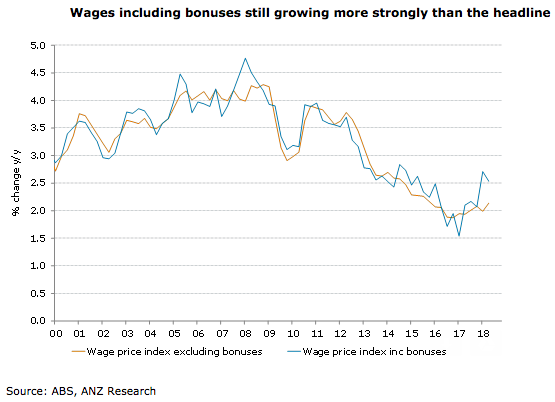

Australia’s wage price growth for the second quarter of this year edged higher but still only very gradually, with annual wage growth ticking up to 2.1 percent, following a downwardly revised 2.0 percent in the first quarter. Growth in the WPI including bonuses is still higher than the headline measure, though it did slow a touch.

The wage price index (WPI) rose by 0.6 percent q/q and 2.1 percent y/y in Q2, in line with expectations. Growth in public wages (0.6 percent q/q) continued to outstrip private wages (0.5 percent q/q), although the gap is gradually closing.

Growth in the measure of wages including bonuses edged down to 2.5 percent y/y from 2.7 percent y/y, although it remains significantly stronger than the headline. This continues to suggest that firms are paying bonuses to attract staff, but at the same time retaining flexibility around costs.

"Looking ahead, we expect to see a further gradual improvement in wage growth in 2018 and 2019. There should be further upside in Q3, when some large enterprise bargaining agreements and the higher-than-usual minimum wage rise of 3.5 percent come into effect. More broadly though, labour market spare capacity is gradually declining, evidenced in the high proportion of firms reporting difficulty finding suitable labour," according to the latest report from ANZ Research.

Meanwhile, from the RBA’s perspective, the ongoing gradual improvement in wages growth is consistent with its view that the laws of supply and demand are working. But a more meaningful acceleration in wages growth will be required before inflation looks to be convincingly heading towards the mid-point of the target band.

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns