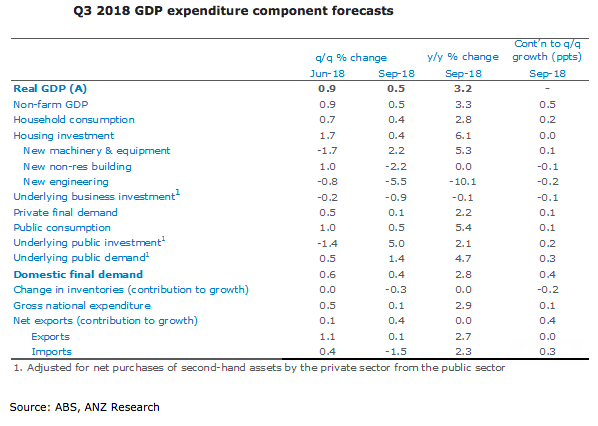

Australia’s gross domestic product (GDP) for the third quarter of this year is expected to have risen a relatively modest 0.5 percent q/q, following a gains of 1.1 percent and 0.9 percent in Q1 and Q2 respectively. This would see annual growth edge down to 3.2 percent.

At +0.5 percent q/q and +3.2 percent y/y, GDP growth looks to have been a little lower than the RBA expected. A step up to 0.9 percent q/q in Q4 would be required to achieve the 3-1/2 percent forecast for Dec 2018.

In tomorrow's report, the focus is likely once again to be on the household indicators - consumption and wages. Weak retail sales volumes (+0.2 percent) and car sales suggest a softer outcome for Q3 consumer spending.

Preliminary data from the business indicators report suggest that was likely to have been soft, with annual growth likely to have decelerated. The combination of weaker consumption and disappointing wages growth if confirmed in the GDP report would be a concern.

The RBA has so far been able to play down the implications of falling house prices, with the view that stronger growth in household income would provide enough support to consumer spending. But with house price weakness accelerating, wages slow to pick up and consumption softening, the outlook may not be so rosy.

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran