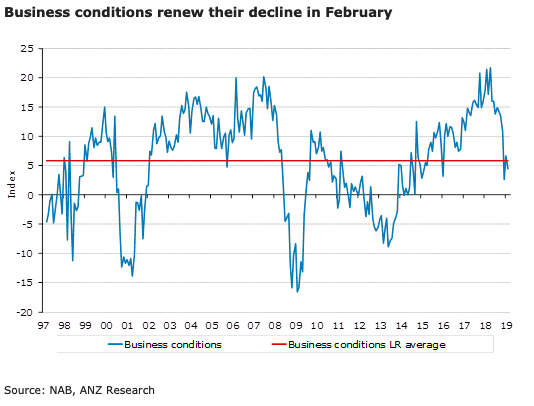

Australia’s business conditions fell to 4.4 in February, reversing much of the bounce in January from the sharply weaker December numbers. Indeed, some of the key numbers are weaker than in December – notably forward orders and exports.

Capacity utilisation fell again, to its lowest level since October 2016. This points to a rising unemployment rate in the months ahead. The weakness in business conditions adds to other evidence of a continued loss of momentum in the economy after the weak Q4, such as the latest ANZ Roy-Morgan Australian Consumer Confidence data, according to the latest report from ANZ Research.

The details of the report were mostly consistent with the headline. One category to counter the downtrend was the employment index, which rose to 5.4 from 5 in January and 3.9 in December. It is still well below the levels prevailing through most of last year, however.

Conditions were mixed across the states. Conditions in NSW fell to the lowest level since 2014, while those in Vic and WA rose a touch. Conditions in SA continued to be volatile, dropping sharply after the big bounce in January. Tas is now the only state where conditions are above the long-run average.

Across industries, construction was down sharply and retail deteriorated further. Meanwhile, the transport and finance categories bucked the overall trend and posted gains.

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Oil Prices Slip as U.S.–Iran Talks Ease Supply Disruption Fears

Oil Prices Slip as U.S.–Iran Talks Ease Supply Disruption Fears  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record