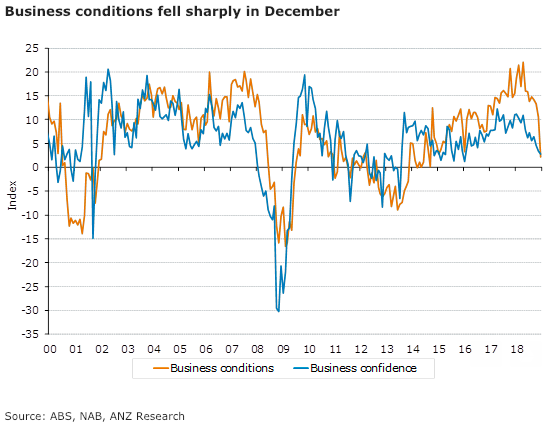

Australia’s business conditions fell sharply in December and now sit below their long-term average for the first time since January 2016. The month-to-month drop was the largest since the Global Financial Crisis (GFC). The deterioration in conditions was fairly broad-based, with mining and construction the only industries to record an improvement in the month.

The drop in business conditions lines up with other indicators, such as motor vehicle sales and building approvals, pointing to a sharp loss of economic momentum. Anecdotes also point to a very weak December for retail sales.

The details of the report were broadly negative. Profitability fell for the fourth consecutive month. The employment index dropped to its lowest level since the end of 2016. Capacity utilisation was down slightly, to 82.0 percent.

Conditions in the retail sector deteriorated further in December from -4.4 to -14.9. Transport fell sharply from 12.7 to -13, and manufacturing dropped to -1.1. Mining sector conditions improved. Construction also improved, but remained below its long-term average

The fall in conditions was widespread across states and territories, with Tasmania the only region to see an improvement. Conditions in New South Wales and Victoria continued to trend lower. Queensland and South Australia saw even sharper slowdowns in December.

"This provides a challenging backdrop for the RBA’s forecast update, especially given the prospect that credit conditions are continuing to tighten (as indicated by the ANZ-Property Council of Australia survey, for instance). The RBA is generally slow to shift its underlying view, but the case for a material shift is building," ANZ Research commented in its latest report.

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom