Private sector credit in Australia grew during the month of November broadly in line with what markets had earlier anticipated. However, other personal credit (which includes credit cards and car loans) remains the major area of weakness in private sector credit. November was no exception.

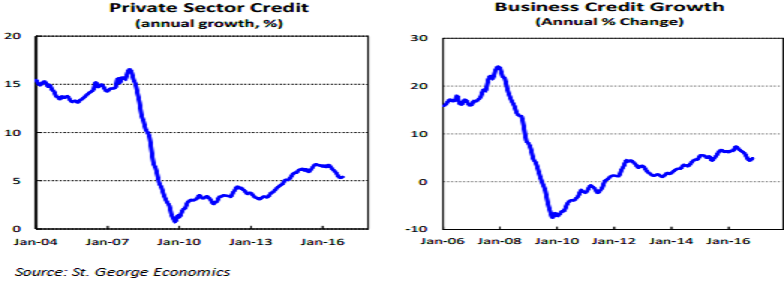

Australia’s private sector credit grew by 0.5 percent in November. This pace is within the 0.4-0.5 percent monthly growth rate witnessed in the past five months. Annual credit growth edged up from 5.3 percent in October to 5.4 percent in November. The long-run average for annual credit growth is 6.1 percent, highlighting the sluggish nature of current credit growth in the economy, data released by the Reserve Bank of Australia (RBA) showed Friday.

The most encouraging piece of the data today was lending to the business sector. Credit growth to businesses rose by 0.5 percent in November, after a 0.5 percent rise in October. The past two months of data have shown a firm pick up in business credit, after a five-month period of only weak growth.

Diverging trends are starting to form in the housing credit data. Low interest rates have stimulated activity among property investors. Credit for investor housing grew at a blistering pace in November, but growth in lending to owner occupiers has moderated.

"Private sector growth was a mixed bag for the month of November. The Reserve Bank will take comfort from today’s figures on business credit. But the central bank is unlikely to be comfortable about the recent return of stronger growth rates in investor lending," St. George Economics said in its latest research report.

Meanwhile, AUD/USD traded at 0.72, up 0.10 percent, while at 4:00GMT, the FxWirePro's Hourly AUD Strength Index remained neutral at 35.55 (a reading above +75 indicates a bullish trend, while that below -75 a bearish trend). For more details, visit http://www.fxwirepro.com/currencyindex

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices