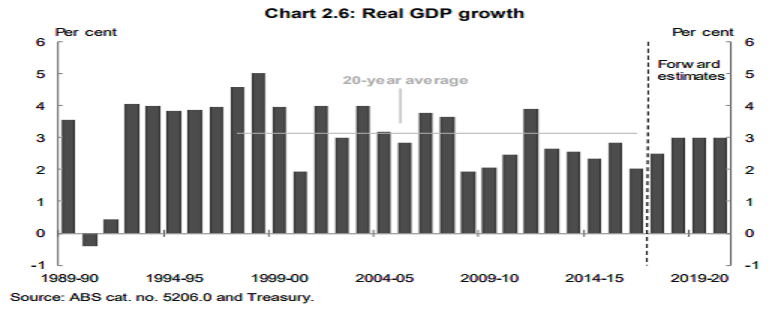

Australia has lowered its forecasts for real GDP growth in 2017-18 in its Mid-Year Economic and Fiscal Outlook (MYEFO), given a slowdown in household consumption. However, it also lowered its forecast for the unemployment rate for 2017-18 and 2018-19, reflecting robust employment growth.

Further, the outlook also revealed an expected budget deficit of AUD23.6 billion for 2017-18, a AUD5.8 billion improvement on the estimate announced in May. The key driver for improvement was the better conditions among businesses, which have in turn lifted the projected tax intake from companies. A combined improvement of AUD9.4 billion is expected over the four years to 2020-21. The expectation that a surplus will be reached in 2020-21 remains intact.

The fact that commodity prices are no longer falling is a big help to the government’s budget. The improvement in business sector conditions and a pickup in global growth should continue to support revenues. The ongoing strength in the labor market would also assist in boosting government coffers, although ongoing soft wage growth is expected to keep a lid on income tax receipts.

The downward pressures on the budget in recent years have subsided. As a result, there is a danger that the pressures on the Government to address the longer-term issue of budget repair has reduced. A surplus is expected in 2020-21, but it continues to rely on an ongoing improvement in economic growth. Achieving the aim of having the budget in surplus, on average, over the course of the economic cycle, therefore, remains questionable.

Meanwhile, FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target