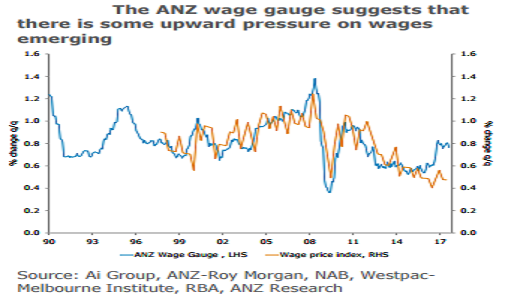

The Australian wage growth is expected to creep higher over the coming years as spare capacity in the labour market is gradually being eroded, job insecurity has fallen, and businesses are reporting some pockets of difficulty in finding suitable labour, ANZ Research reported.

The RBA would also have been disappointed by the today’s weak results. The Bank has expressed confidence on a number of occasions that wage growth would improve, but that confidence will be tested by the weakness apparent in these numbers. Ongoing very-low wage growth and its implications for both the consumption and inflation trajectory suggest that monetary policy is likely to remain stimulatory for some time.

The wage price index (WPI) rose by just 0.5 percent q/q in Q3 and is up 2.0 percent over the year. This was significantly weaker than market expectations and below our own forecasts. Both private and public sector wages rose 0.5 percent q/q.

The soft result was also shown in the industry breakdown. Even some industries which would have a high proportion of award workers (whose wages would have been boosted by the minimum wage), annual growth in wages slowed. The retail sector, for example, saw wage growth slow from 1.8 percent y/y in Q2 to 1.6 percent in Q3.

FxWirePro launches Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock