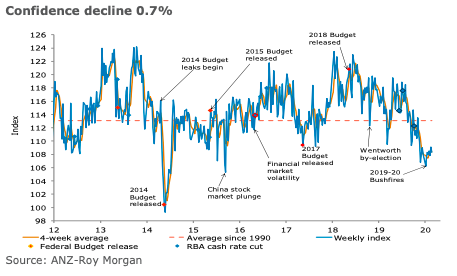

Australia’s ANZ-Roy Morgan consumer confidence declined 0.7 percent last week, driven lower by weakness in financial conditions.

‘Current finances’ fell 4 percent compared to the prior week, while ‘future finances’ declined 5.2 percent - its second straight weekly loss. In contrast to the weakness in financial conditions, confidence in economic conditions rose.

‘Current economic conditions’ gained 2.4 percent, building on the strong rise of 6.5 percent in the previous reading. ‘Future economic conditions’ rose 2.7 percent.

‘Time to buy a major household item’ gained 1.7 percent, after declining for two successive weeks. The four-week moving average for ‘inflation expectations’ was stable at 4 percent.

"A sharp rise in unemployment and underemployment may explain the fall in ANZ Roy-Morgan Australian Consumer Confidence index last week. Overall confidence is up from its recent low, though still well below average. The decline in confidence was due to weakness in the financial conditions subcomponent. It is possible that news about rising labour market has slack has people concerned about their personal finances. Sentiment toward ‘current finances’ is down 7.5% from its early January high, though still a touch above average. In contrast to the weakness in financial conditions, sentiment toward economic conditions was higher. It is still well below that on financial conditions, however, though the gap between the two has narrowed," said David Plank, ANZ’s Head of Australian Economics.

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient