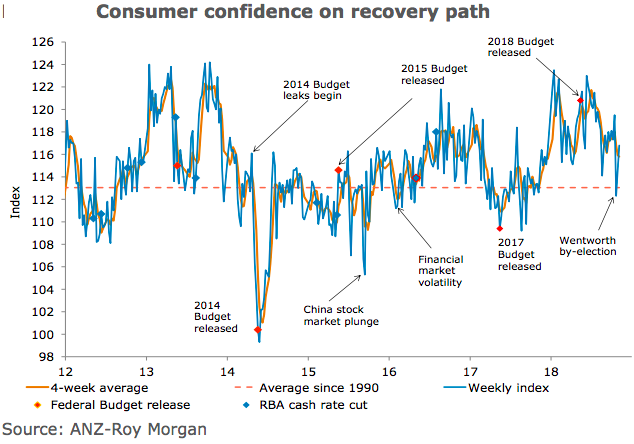

Australia’s ANZ-Roy Morgan consumer confidence continues recovering from the dive seen the weekend of the Wentworth by-election. This week’s 1.9 percent rise means confidence has regained almost two thirds of the drop.

Performance across the sub-indices was mixed. While households’ perceptions of current financial conditions rose by 1.7 percent, sentiment regarding the future financial situation fell by 0.4 percent. Both the sub-indices of economic conditions fell. Current and future economic conditions fell by 1.9 percent and 0.4 percent respectively.

The 'time to buy a household item' sub-index jumped sharply, gaining 9.7 percent. Despite this sharp gain, this sub-index is no higher than it was a few weeks back. Four-week moving average inflation stabilised at 4.5 percent. There has been considerable volatility in weekly inflation expectations of late.

"The recovery since then, back to a level well above the long-run average, suggests that the plunge was largely due to the by-election. Since then the economic backdrop, which has seen the unemployment rate drop to 5 percent, seems to be supportive enough to offset negative influences such as the weakness in housing," said David Plank, ANZ’s Head of Australian Economics.

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions