Australia’s business conditions fell again in October, from a downwardly-revised September result. This meant that conditions are now at the lowest level since November 2016.

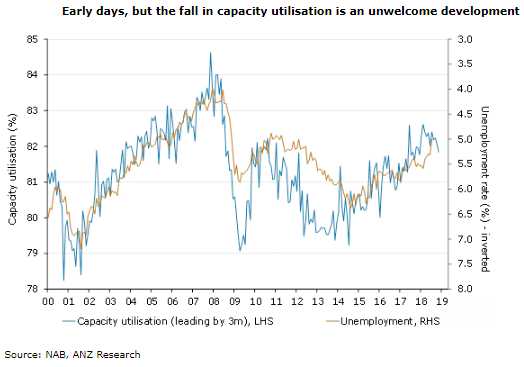

The details of the report were soft across the board. The two key components that give us a read on the labor market were down, with capacity utilization slipping to the lowest level in a year and profitability the lowest in two years. The drop in capacity utilization, in particular, is disappointing.

This had previously signaled that the labor market was in good shape, and markets have subsequently seen the unemployment rate fall to 5.0 percent. While only a very gradual fall in the unemployment rate was expected from here, further drops in capacity utilization would be cause for concern that unemployment could head back up from here.

Weakness in business conditions was evident across most industries, but the decline in the finance, business and property segment stands out. Conditions in the sector are now at the lowest level since 2015 and are well below the long-term average.

This is unsurprising given the weakness in the housing market and the ongoing impact of the Royal Commission. In brighter news, the construction sector bucked the trend in October with a solid increase in conditions, likely supported by the many infrastructure works across the country.

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient