Australia is quite stable with low political risk associated but in recent times, the economy is facing headwinds from over dependency as a commodity exporter to china. China's economy is slowing down fast from over a decade long double digit growth.

Australia & New Zealand have the highest rates of interest, 2.25% in Australia and 3.5% in New Zealand.

These currencies get benefited over carry trade that is investing in currencies with relative high interest and borrowing from the lower ones (JPY, Euro). Currencies also tend to track the yield spread.

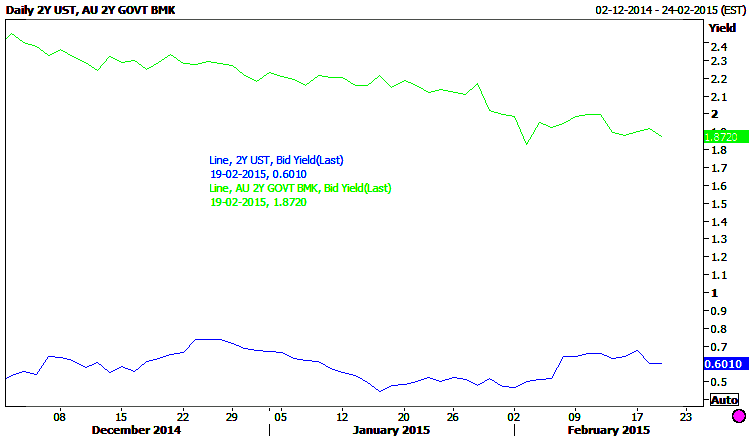

So far the evidence shows, the yield spread between the US and Australia still falling. Also to note the Reserve bank of Australia recently sought to easing path.

This view keeps us

- Bearish on the AUD/USD exchange rate.

- Bullish over the Australian govt. securities.

- Mild bullish on the equities as they still face headwinds from china but falling interest rate will help them in the longer run.

Chart is attached with 2 year yields of US & Australian govt. securities.

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?