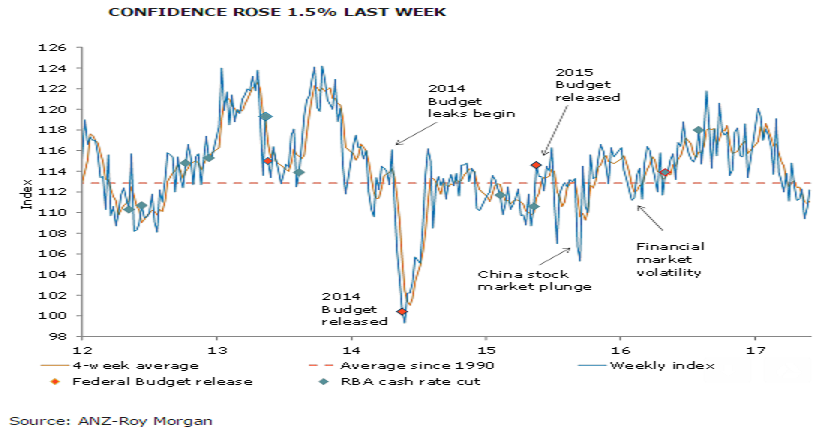

Australia’s Consumer confidence increased for the second straight week, up 1.5 percent to 112.2, bringing the index back to levels before the Commonwealth Budget. The improvement in confidence was mixed; sentiment towards financial conditions deteriorated somewhat, while views around economic conditions rose solidly.

Households’ expectations towards both current and future economic conditions bounced last week (3.5 and 4.6 percent respectively), after posting modest rises the previous week. Sentiment towards current economic conditions is at its highest value in seven weeks.

Households’ views on current financial conditions were broadly flat (-0.1 percent). Meanwhile, views towards future conditions dropped 1.7 percent, offsetting the 1.5 percent rise in the previous week. Confidence in overall financial conditions has fallen sharply since the Commonwealth Budget, unwinding the modest recovery in April.

The weekly inflation expectations series dropped sharply to 4.0 percent last week, bringing the 4-week average to 4.3 percent.

"In our view, consumer confidence is likely to improve further over the next few months, albeit slowly, as elevated business conditions feed into stronger labour market conditions. That being said, confidence may be volatile over the next few weeks given the flow of data culminating with the Q1 GDP release as well as evolving global political conditions," said David Plank, Head, Australian Economics, ANZ.

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off