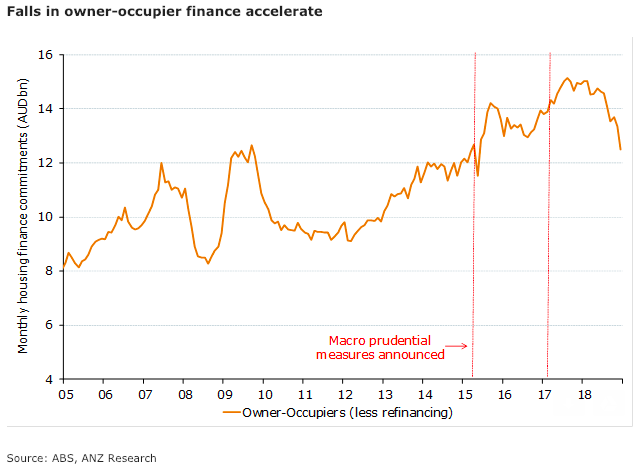

Australia’s housing finance continued to fall in December, with the largest falls seen for owner-occupiers. Finance for first home buyers, which had previously outperformed other segments, fell sharply in December.

Total financing is down 20 percent over the last year, and further falls are likely in the near term. A sustained improvement in housing finance would be an early indicator of a stabilisation in the housing market.

The value of housing finance commitments fell at a faster rate in December. Finance approvals are now 20 percent lower over the year. Further declines are likely as tighter lending standards continue to filter through, ANZ Research reported.

The value of finance for owner-occupiers fell 6.4 percent m/m, leaving it 16.2 percent lower for the year. Investor finance fell 4.6 percent in the month and is 27.8 percent lower year on year.

Within the owner-occupier category, the trend of first home buyer outperformance has ended, as it declined 8 percent m/m. As a share of the value of total housing finance (excluding refinancing), first home buyers were 16 percent, down from 17 percent in November. It appears that tighter lending standards are now affecting this segment.

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record