Australian retail sales remained stringer-than-expected during the month of April, led by strong sales growth in cafes, restaurants and takeaway food. In contrast, sales of clothing fell sharply. Possibly the unseasonably warm weather impacted sales trends, and the warm weather extended into May.

Interestingly, despite ongoing moderation in house prices, spending on furniture and hardware related items rose strongly. New South Wales and Western Australia led the growth in April, but in annual terms, sales growth remains the strongest in Victoria.

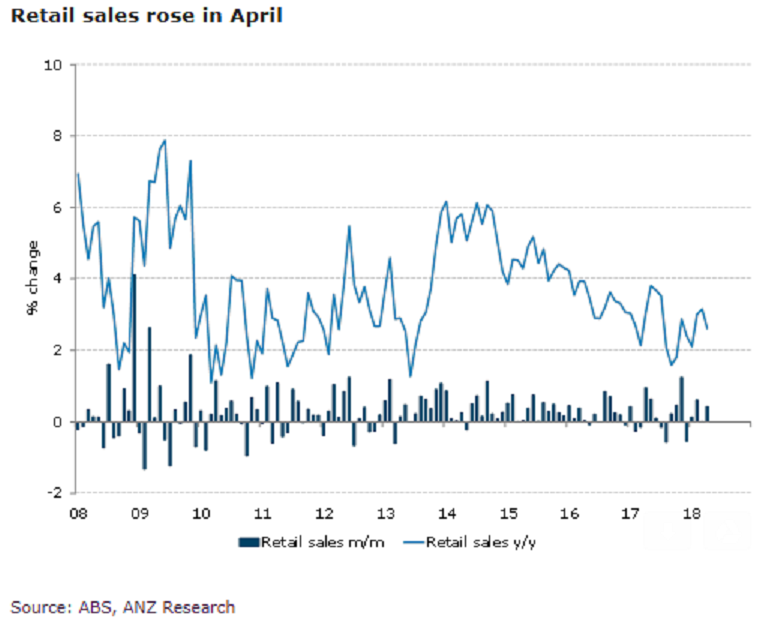

Retail sales had a solid start to Q2, rising by 0.4 percent m/m in April. In annual terms, retail trade growth slowed to 2.6 percent y/y, from 3.2 percent y/y in March. Sales in three month-end annualized terms, however, accelerated to 4.3 percent, from 3.1 percent in March and just 0.8 percent in February.

Further, sales rose solidly in New South Wales (0.7 percent m/m) and Western Australia (0.7 percent m/m). South Australia was the only state to see a decline in retail sales (-0.6 percent m/m). Sales were very strong in the Northern Territory and also up solidly in Tasmania. In annual terms, Victoria continues to show the strongest growth, with sales up 4.7 percent y/y in April.

"Despite the better-than-expected outcome, we remain cautious about consumer spending, particularly for discretionary items, given the slowdown in the housing market and high petrol prices," ANZ Research commented in its latest report.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm