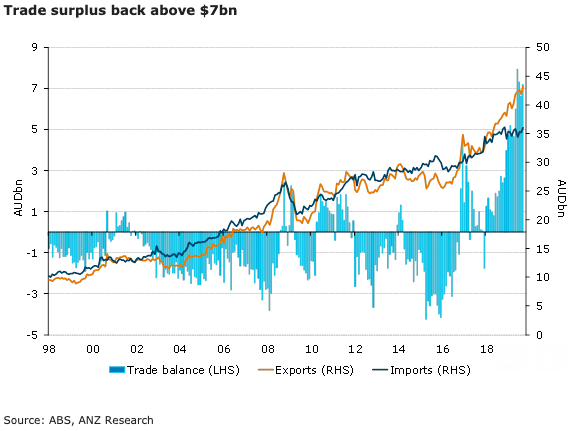

Australian trade balance lifted back above $7bn in September, comfortably beating market expectations; the country’s August surplus was revised up by nearly $700 million, ANZ Research reported.

The monthly trade surplus rose to $7180 million in September, a decent gain on the upwardly revised August result and matching the more than $7,000 million monthly surpluses recorded in June and July.

Total resource exports rose 4.5 percent m/m in September and are now 22 percent higher than a year ago. Much of the gain has been driven by gold exports, however. Excluding non-monetary gold, resource exports were up 2.3 percent m/m and are just 1 percent higher than a year ago.

Rural exports were up a strong 6.4 percent m/m, driven by a sharp rise in cereal exports. Compared to a year ago, rural exports are down 2.3 percent. Service exports are up 0.8 percent m/m.

Capital imports excluding civil aircraft rose a strong 11 percent m/m and are 8.7 percent higher than a year ago. Much of the gain was in telecommunication equipment. Consumption imports remain soft and are little changed from a year ago, not overly surprising given the weakness in household spending.

Exports were up 3.5 percent m/m to be nearly 15 percent higher for the year. Imports gained 2.5 percent m/m, but are only up 3.2 percent y/y. It was encouraging to see capital goods imports rise by 11.6 percent m/m, for an annual gain of 8.2 percent. Imports of consumption goods were very subdued, up just 0.7 percent m/m and 0.8 percent y/y, the report added.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality