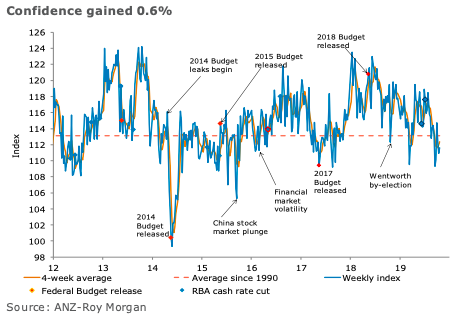

Australia’s ANZ-Roy Morgan consumer confidence made a partial recovery last week, rising 0.6 percent after the prior week’s 1.2 percent drop. Current finances dropped 2.4 percent, however. This component is now down nearly 10 percent from its August high. Future finances gained 0.4 percent, taking it back above its long term average.

Current economic conditions gained 0.3 percent, while future economic conditions declined by 1.1 percent. Both the sub-indices are below their long-term average.

The ‘Time to buy a household item’ measure gained 5.1 percent. There have been some big up and down swings in this measure in recent months, but it remains below its long-run average. Inflation expectations were stable at 4.1 percent.

"Confidence eked a small gain on the back of a strong rebound in the ‘Time to buy a household item’ sub-index. Outside of this, the results were mixed, perhaps reflecting the news flow over the week. On the positive side, Australia’s unemployment rate moved lower on the back of a decent employment report. But the IMF’s downgrade to Australia’s economic outlook attracted a lot of attention, as did the slowdown in China’s data. Of particular note, current finances dropped 2.4 percent – the second big fall in the past three weeks. This measure is still well above average, but is now down close to 10 percent from its August high. If consumers lose confidence in their own finances when they are also worried about the broader economic outlook then there may be a material impact on spending," said David Plank, ANZ’s Head of Australian Economics.

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  U.S. Stock Futures Edge Higher as Tech Rout Deepens on AI Concerns and Earnings

U.S. Stock Futures Edge Higher as Tech Rout Deepens on AI Concerns and Earnings  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Oil Prices Slip as U.S.–Iran Talks Ease Supply Disruption Fears

Oil Prices Slip as U.S.–Iran Talks Ease Supply Disruption Fears  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX