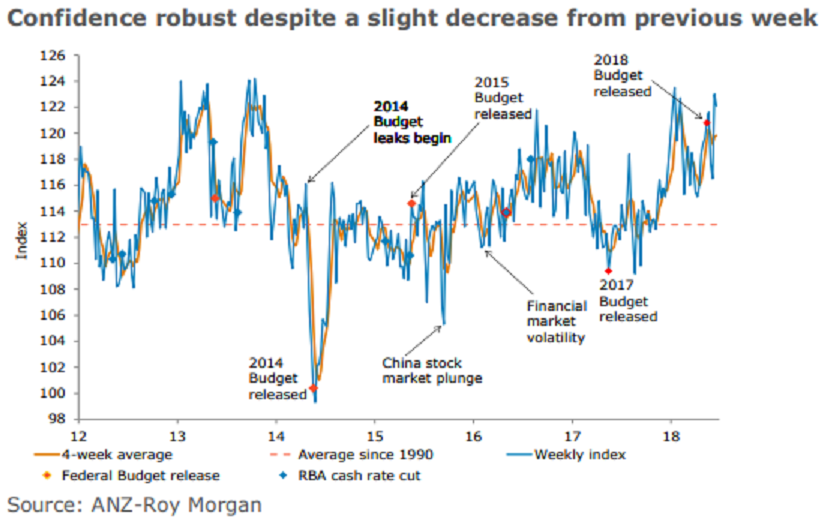

Australia’s ANZ-Roy Morgan consumer confidence weakened slightly by -0.7 percent over the week to 122.1, a solid performance following the large 5.6 percent jump the previous week and leaving the index comfortably above its long term average. The details were mixed, with two out of the five sub-indices posting positive readings.

Expectations about future financial conditions rose 3.1 percent, building on the 1.6 percent gain seen over the week before. The index is now at its highest since January 2017. Views towards current financial conditions, however, fell 4.9 percent over the week, but remained above the long term average.

Consumers’ views towards economic conditions deteriorated. The future economic conditions index fell slightly (-0.8 percent) from the previous week. The current economic conditions index fell 3.8 percent to 110.9, reversing some of the sizeable gain posted the previous week (8.9 percent).

The 'time to buy a household item' sub-index rose 1.6 percent last week to 146.3, the highest since January 2016 and well above its long term average (134.0). Four week moving average inflation expectations edged up to 4.6 percent (previously 4.4 percent).

"Given uncertainties about trade protectionism and domestic concerns, we remain cautious about how easily upbeat confidence will be reflected in stronger consumer spending. Indeed, we continue to see a pick-up in wages as essential for a boost to overall household spending," said Jo Masters, Senior Economist, ANZ Research.

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals