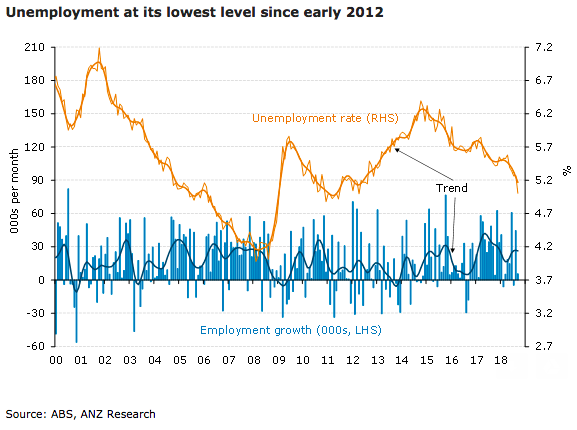

Australia’s strong labour market report for September saw the unemployment rate drop to a six-year low of 5.0 percent, well below the RBA’s forecast of 5-1/2 percent for year end. With leading indicators for the labour market pointing to ongoing solid growth in employment, the unemployment rate is expected to continue to gradually trend lower, according to the latest report from ANZ Research.

Employment rose a modest 5.6k in September, after the 44.0k jump in August. The strength was concentrated in full-time jobs (+20.3k), while part-time jobs fell (‑14.7k). The participation rate dipped down to 65.4 percent from 65.7 percent, potentially suggesting to some analysts that the drop in the unemployment rate is somehow less ‘real’ than it appears. Careful interpretation of the participation rate data is important.

The RBA’s latest forecasts have the unemployment rate at 5-1/2 percent by the end of 2018 and 5-1/4 percent by the end of 2019. The drop in the unemployment rate to 5 percent in September suggests that the November SoMP will likely see the forecast trajectory for the unemployment rate nudged down to reflect the lower starting point. A forecast of under 5 percent by the end of 2019 seems likely.

"We expect that the RBA is, however, less likely to upgrade its inflation forecasts on the back of the improved outlook for unemployment. Given Australia’s experience to date, and the experience of a number of overseas economies, it is likely that the unemployment rate will have to track below current estimates of the NAIRU for some time before material wage pressures emerge," the report also commented.

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals

Gold and Silver Prices Slide as Dollar Strength and Easing Tensions Weigh on Metals  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns