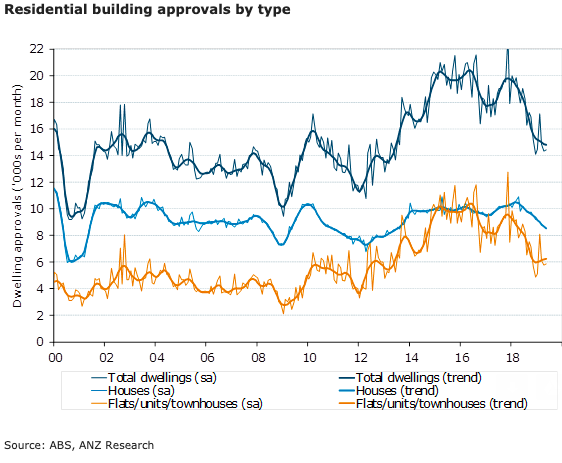

Australia’s building approvals grew modestly during the month of May, albeit remaining well below its highs. However, the easier financial regulations by the APRA and historically low cash rate will further lend support to these approvals, according to the latest report from ANZ Research.

The country’s residential building approvals grew tad 0.7 percent m/m in May, a slight reversal after the sharp declines in March and April (13.4 percent and 3.4 percent m/m respectively). Private sector unit approvals were up 1.2 percent m/m, to be down 20.1 percent y/y.

Private sector house approvals were down 0.3 percent m/m and are now down 12.7 percent y/y. More broadly, a slight pick-up in unit approvals are providing some offset to weaker house approvals.

The month of May highlighted strength in Victoria, where total approvals were up 14.4 percent m/m, driven by an impressive 40.9 percent m/m growth in the volatile unit component. Total NSW approvals were flat, representing a modest tick-up in house approvals, offset by unit weakness.

QLD and SA both saw declines in approvals (-6.3 percent m/m and 2.9 percent m/m respectively), driven by declines in unit approvals; while WA saw a total decline of 4.7 percent driven by weakness in house approvals.

NSW is leading the way on approvals, particularly in units, which have shown a sharp recovery in recent months. Meanwhile, non-residential approvals fell in May although in trend terms they look to be stabilising both in public and private terms, the report added.

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength

Russian Stocks End Mixed as MOEX Index Closes Flat Amid Commodity Strength  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination