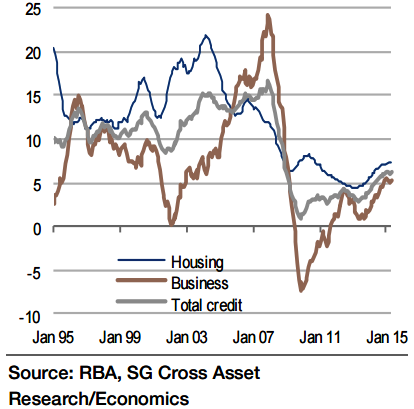

The current rate of Australia's credit growth is charecterized by RBA as "moderate", and from a purely historical perspective this is correct. However, the 6-plus percent rate to be rather strong, it is well above nominal GDP growth of 3.1% in 2014 and 1.2% yoy in Q1 2015.

Now, because nominal GDP growth is primarily depressed by falling export prices, the comparison with nominal GDP may not be the best, but even nominal domestic final demand growth was just 3.1% in 2014 and 2.3% in Q1 2015.

"The debt to GDP ratio continues to rise. That said, it appears that private sector credit growth is now stabilizing at this 6-plus percent rate, at least in the short term, ending a two-year period of acceleration", says Societe Generale.

Mortgage growth to owner-occupiers and to housing investors is stabilizing at around 5.7% and a bit over 10%, respectively, and despite the RBA's two 25bp rate cuts in the first half of the year, we do not expect much strengthening from here.

At the same time, any near-term weakening is not expected either given these rate cuts, strong house price dynamics and buoyant housing approvals. The other main component, credit to businesses, has in our view potential to accelerate as non-resource investment strengthens, and this could happen relatively quickly depending on the success of the special depreciation allowance introduced in the latest federal budget.

"Other personal credit, is likely to continue to stagnate, but it is too small to make much difference. In June, the annual rate of growth is likely to decline noticeably, but that is only because of a large base effect", added Societe Generale.

Australia's credit growth stabilizing at a respectable rate

Thursday, July 30, 2015 6:04 AM UTC

Editor's Picks

- Market Data

Most Popular

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX