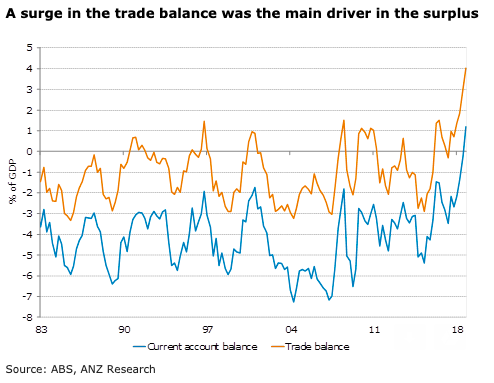

Australia’s current account was in surplus in Q2, improving upon the revised AUD1.1bn (previously AUD2.9bn) deficit in Q1. The trade balance increasing to AUD19.9bn from AUD14.8bn was the main driver of this surplus. The fall in the income deficit added to the size of this surplus by decreasing from AUD15.5bn to AUD13.9bn this quarter, ANZ Research reported.

Export volumes rose 1.4 percent q/q led by a 2.4 percent increase in resources. Coal was the main driver of resource exports, up 3.7 percent q/q while iron ore exports were only up 0.6 percent q/q. Meanwhile rural goods fell 4.3 percent q/q, with weakness seen across most rural categories. Non-monetary gold fell 12 percent q/q in Q2 following the 39.2 percent increase in Q1.

Import volumes fell 1.3 percent q/q reflecting declines across most categories. The biggest decline was from consumption goods, which fell 2.9 percent q/q. The decline in consumption goods was driven by household electrical items falling 6.1 percent and car imports declining 10.6 percent for the quarter.

The terms of trade rose by 1.5 percent q/q, reflecting a large rise in export prices (+2.5 percent) and an increase in import prices (1.0 percent).

"We anticipate further solid trade surpluses going forward, but Q3 looks likely to be a little lower given the fall in commodity prices. The net exports contribution to GDP growth was also stronger than the market expected. Given the weakness seen in other parts of the economy, continued strength in trade will be important for GDP going forward," the report further commented.

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions