Australia’s housing finance commitments were down again in April, in line with market expectations. The value of Australian housing finance commitments fell again in April, albeit not as sharply as the previous month. The weakness was again driven by the investor segment, while owner-occupier borrowing was flat.

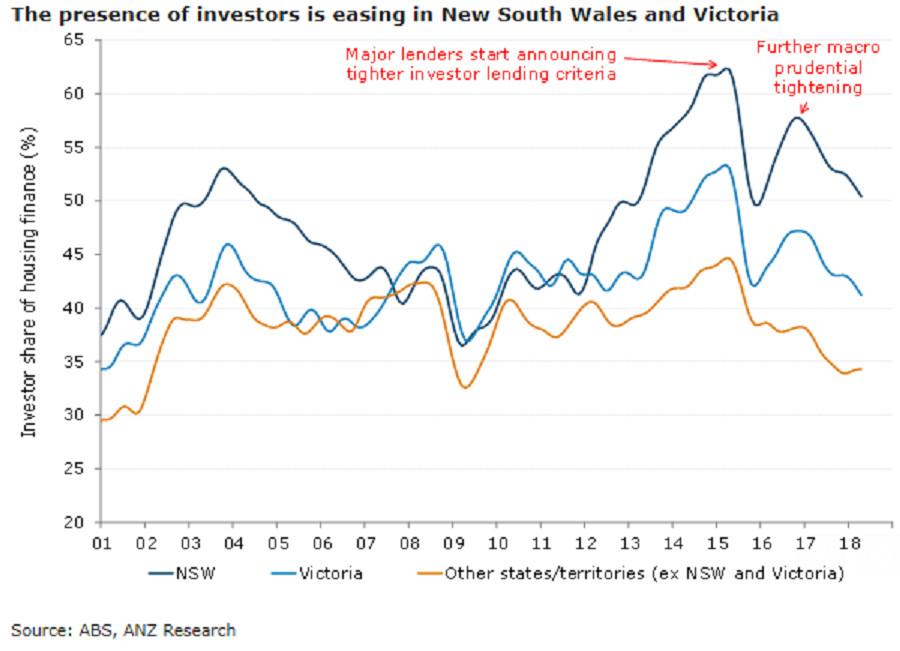

The share of borrowing by investors continues to fall, and at 42 percent is the lowest since 2012. New South Wales and Victoria have seen the sharpest declines, consistent with the rapid cooling in their respective housing markets in recent months.

Investors did return to the new property market, with finance for the construction of new dwellings mostly offsetting last month’s fall. However, further weakness in the new property segment from owner occupiers means that overall finance for the construction and purchase of new dwellings continues to trend lower. This suggests that building approvals will follow suit in the coming months.

Finance approvals for first home buyers in these two states are down 8 percent from the November 2017 peak. While falling house prices are broadly positive for these buyers, further credit tightening is likely to weigh on the segment.

"Looking forward, tighter credit conditions are likely to continue to bite, suggesting that housing finance will remain soft for some time yet," ANZ Research commented in its latest report.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock

U.S. Stock Futures Slide as Tech Rout Deepens on Amazon Capex Shock  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off