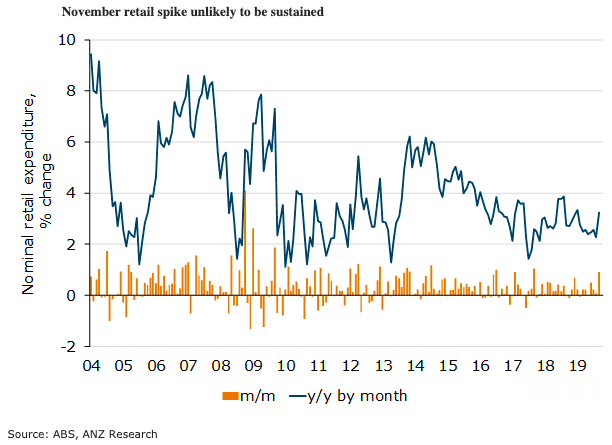

Australia’s annual growth in retail sales lifted to 3.2 percent y/y in November. This is the strongest y/y result by month since March, and is above the average yearly growth result for the last three years.

However, this is unlikely to be sustained, as some of the strength in November is likely to result in symmetrical weakness in December, as people pulled forward their discretionary spending for Black Friday, ANZ Research reported.

Black Friday pushed up non-food sales, which grew 1.2 percent m/m, compared to 0.6 percent m/m for food sales. This nominal difference is subdued compared with what likely happened to volumes, as food prices have been rising faster than non-food prices in the last year. Black Friday’s heavy discounting likely pushed down average prices for non-food sales in November.

Department stores (3.4 percent m/m), fashion (3.1 percent m/m) and electronics (2.1 percent m/m) drove the strong result for November. Takeaway food also grew well (2.1 percent m/m), after sales in the category went backwards the last few months.

Annual growth results show the persistence of subdued household spending on non-essential categories, as food rose 3.7 percent y/y while non-food only rose 2.7 percent. Fashion (4.9 percent y/y), department stores (4.4 percent y/y), pharmaceuticals, cosmetics and toiletries (4.3 percent y/y) were the strongest non-food categories, while household-related categories and recreation were weakest.

Monthly growth was weakest in the South East in both October and November. NSW grew only 2.1 percent y/y, while VIC and SA grew 2.9 percent and 3.0 percent y/y respectively. Qld (5.4 percent y/y) and Tas (5.3 percent y/y) led annual growth.

"The bushfires and smoke haze may downgrade retail sales over December and January and fundamental difficulties for households, including sluggish wage growth, high household debt and rising non-retail expenses (such as utilities, housing, education and health) are likely to keep a lid on retail growth for at least the early part of 2020," ANZ research further commented in the report.

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient

Singapore Budget 2026 Set for Fiscal Prudence as Growth Remains Resilient  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices