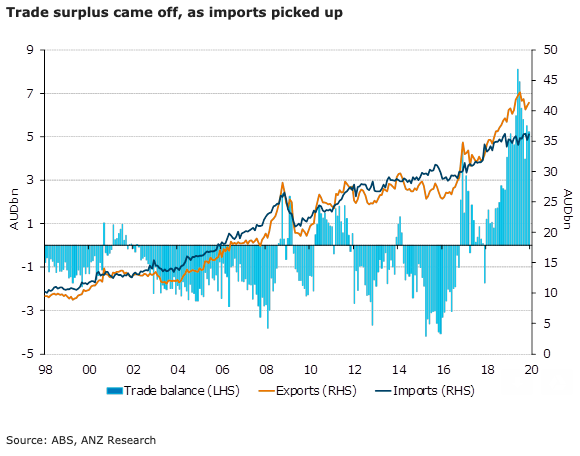

Australia’s trade surplus fell slightly to AUD5.2 billion in December, below market expectations. The decline was driven by a larger rise in imports compared to exports. Imports rose 2.4 percent m/m, while exports were up 1.4 percent m/m.

Stronger resource exports were the primary drivers of the pick-up in exports, while service exports fell. Imports were up across the board, with sharp rises in capital and consumption goods imports.

Total resource exports rose 2.9 percent m/m in December and are now 12.1 percent higher than a year ago. The increase largely reflects higher iron ore exports, which rose 3.3 percent m/m, as well as LNG, up 2.6 percent m/m.

Non-monetary gold continued its recent volatility rising 14 percent m/m after declining 6 percent in the previous month. The RBA’s commodity price index was down 1.1 percent in December, which suggests that the rise in resource exports was likely due to a rise in volume.

Manufacturing exports continued to decline, by 3.3 percent m/m. Service exports had the first material decline in some time, falling 1.1 percent m/m.

Capital goods were up 6 percent m/m, leading the increase in imports. A large part of this was due to increased transport equipment imports, which rose 23 percent m/m. Consumption goods had a strong month, largely reversing the decline from November. Fuel imports, for example, were up 4.7 percent m/m.

"Given the preliminary December quarter trade balance, net exports are unlikely to contribute much to GDP growth," ANZ Research commented in its latest report.

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record

Vietnam’s Trade Surplus With US Jumps as Exports Surge and China Imports Hit Record  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility

Dollar Near Two-Week High as Stock Rout, AI Concerns and Global Events Drive Market Volatility  Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off

Silver Prices Plunge in Asian Trade as Dollar Strength Triggers Fresh Precious Metals Sell-Off