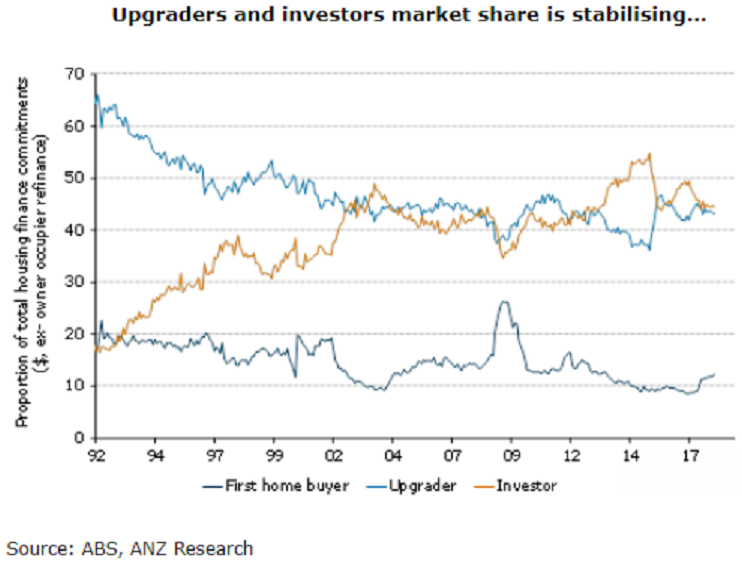

Australia’s value of new housing finance approvals rose again in February, with growth across all sectors. The increasing presence of first home buyers is driving strength in the owner-occupier segment, while investor borrowing appears to have finished its earlier decline.

The value of Australia’s housing finance commitments rose by another 1.0 percent m/m. This pushed annual growth back into positive territory (albeit only just), providing further evidence that housing finance is stabilizing.

The monthly increase was driven by the owner-occupier segment, which rose 1.4 percent m/m. Investors were up a more subdued 0.5 percent m/m, following from the 1.4 percent m/m rise in January. This is the first time in nearly 18 months that investor borrowing has posted consecutive increases.

Underpinning the rise in owner-occupier borrowing was another solid increase in first home buyer activity. First home buyer lending is up more than 40 percent over the past year, and accounted for 12.4 percent of all housing finance in February.

"That is the highest share of borrowing in nearly five years. From the perspective of getting first home buyers into the market, the NSW and Victorian state governments’ stamp duty incentives are working a charm," ANZ Research commented in its latest report.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market

Lee Seung-heon Signals Caution on Rate Hikes, Supports Higher Property Taxes to Cool Korea’s Housing Market  Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence

Nikkei 225 Hits Record High Above 56,000 After Japan Election Boosts Market Confidence  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility

Global Markets Slide as AI, Crypto, and Precious Metals Face Heightened Volatility  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target

Bank of Japan Signals Readiness for Near-Term Rate Hike as Inflation Nears Target  UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves

UK Starting Salaries See Strongest Growth in 18 Months as Hiring Sentiment Improves