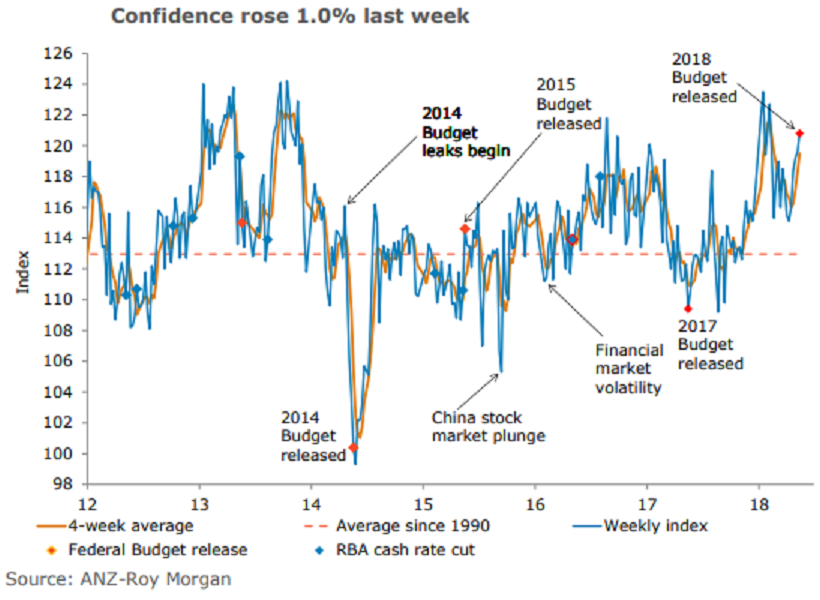

Australia’s ANZ-Roy Morgan consumer confidence rose for the fifth straight week – up 1.0 to 120.8, the highest in 14 weeks. The details were broadly positive with four out of five sub-indices posting gains.

Households’ views towards current financial conditions inched up 0.7 percent last week, largely recovering from the 0.8 percent fall last week. Views towards future conditions rose 1.4 percent, partially reversing the 3.2 percent fall previously. Both sub-indices remain above their long-term averages.

Consumers were particularly optimistic about economic conditions. Sentiment around current conditions bounced 2.4 percent to 113.2, the highest level in 14 weeks. At the same time, views towards future conditions rose a sharp 3.7 percent to 117.5, the highest level in 15 weeks.

The 'time to buy a household item' sub-index decreased 2.7 percent last week, partially undoing the 5.0 percent gain in the previous week. The weekly inflation expectations value slipped to 4.1 percent.

"With confidence currently at its highest point since early February, we now look to the wage and employment reports out later this week, which could set the tone for confidence in the short run," said David Plank, head of Australian Economics at ANZ Research.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns

South Korea Assures U.S. on Trade Deal Commitments Amid Tariff Concerns  Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility

Dow Hits 50,000 as U.S. Stocks Stage Strong Rebound Amid AI Volatility  Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination

Gold and Silver Prices Rebound After Volatile Week Triggered by Fed Nomination  Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals

Gold Prices Slide Below $5,000 as Strong Dollar and Central Bank Outlook Weigh on Metals  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal