Woe is not over for pound.

BOE -

- Bank of England (BOE) policymakers maintained rhetoric for rate hike so far.

- Recent comments suggested concerns over inflation and strength of pound.

Today chief economist of BOE, Andy Haldane raised the possibility of rate cut for the first time in recent past. Mr. Haldane expressed that his comments are personal but the trick worked. Pound dropped from high pretty fast, 1.49 to 1.476. Mr. Andy said, situation is balanced, tilting over to any side is possible.

If comments from MPC members turn out to be dovish in future, pound will fall a lot more.

Volatility -

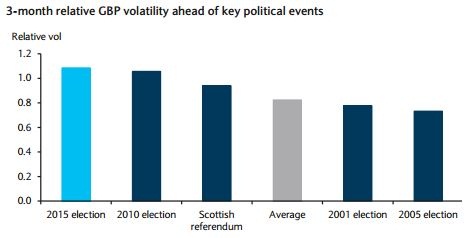

- Data points that market is preparing for high volatility over this year's UK election.

- Actual implied volatility as measured from the options market, is already above 10%.

- Hedging cost for downside is more.

- Cost to hedge against Euro is more.

However relative volatility is well above and stands at 0.4% point above average. Market is expecting this event to be more volatile than previous elections and even Scottish Referendum. Chart courtesy FT.

Pound is trading at 1.4715, down 1.64% today.

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?