Bank of Japan (BOJ) will announce its monetary policy decisions tomorrow sometime in early Asian hours. Speech by Governor Kuroda is scheduled at 3:00 GMT.

Current monetary policy -

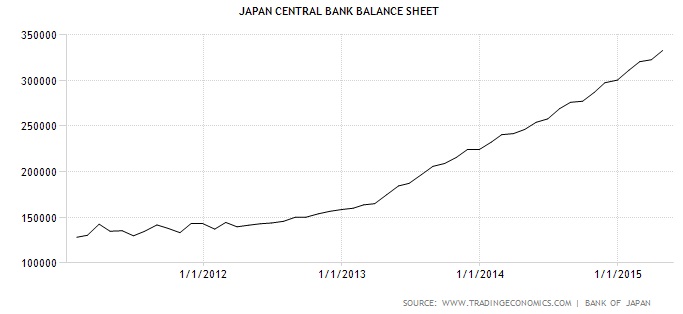

- BOJ is holding policy rates near zero at 0.1% and pursuing monetary easing through asset purchase (Govt. Bonds, ETFs,REITs) since 2012 and has increased the pace of purchase to ¥ 80 trillion per annum in last October.

- This massive rate of purchase has pushed Central bank's balance sheet to record high. As of latest now balance sheet size of BOJ stands at ¥ 332 trillion.

Policy expectation -

- BOJ policymakers are most likely to hold policy steady.

Why it is likely to hold policy steady?

Liquidity -

- Current pace of purchase has already reduced the liquidity in the world's second largest bond market.

- Bank of Japan's purchase is already crowding out the market. In some series BOJ has gobbled 70-80% of the issuance.

- At current rate of purchase, by 2016 BOJ will hold 40% of Japanese debt.

Division among policymakers -

- BOJ board remains heavily divided. Last action came with 5 member voting in favor while 4 opposed further purchase increase in October 2014.

- BOJ policymakers Mr. Kiuchi has voted in favor of reducing purchase in March meeting and according to Mr. Ishida purchase pace stands at max.

Impact on Yen?

- Not much impact on Yen, as policy is already factored in price. However holding it steady might push Yen higher by few pips and sellers are expected to emerge there.

- Yen is most likely to continue its downward path against dollar. Yen is currently trading at 121 against dollar and most likely to lose further grounds.

- Focus will be on speech from Governor Kuroda at 3:00 GMT

FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand