Bitcoin (BTCUSD) hit a fresh all-time high of $98,370 on positive sentiment and is currently trading around $98,010.

Marathon Digital Expands Bitcoin Acquisition Strategy

Marathon Digital Holdings, a prominent U.S. Bitcoin mining company, announced on November 20, 2024, that it is ramping up its Bitcoin acquisition strategy by increasing its debt offering to $1 billion. This includes issuing $850 million in convertible senior notes, with an option to expand due to strong demand. The funds will be used to acquire more Bitcoin and refinance existing debt, with about $199 million allocated to repurchase part of its 2026 convertible notes. Currently, Marathon holds around 27,562 Bitcoins valued at approximately $2.5 billion, making it one of the largest public holders of Bitcoin. CEO Fred Thiel emphasized the company's long-term vision of treating Bitcoin as a crucial treasury reserve asset to encourage institutional adoption.

Whale Accumulation Signals Market Confidence

Recent whale activity in the Bitcoin market has shown significant accumulation, with one whale buying 3,289 BTC (about $302 million) from Binance in just two days. This purchase increased the whale's total holdings to 25,010 BTC, worth around $2.37 billion. The recent buying trend indicates strong bullish sentiment among large investors, contributing to Bitcoin's price surge, which has recently surpassed $94,000, reaching a new all-time high. Additionally, the launch of Bitcoin ETF options by BlackRock has boosted interest and investment in the market. Overall, these developments reflect growing confidence in Bitcoin among big investors.

Surge in Bitcoin ETF Inflows

On November 20, 2024, Bitcoin exchange-traded funds (ETFs) in the U.S. saw significant inflows of about $773.47 million, bringing the total to over $1.8 billion in just three days. Most of the inflows went to BlackRock’s IBIT ETF, which received $626.52 million, highlighting its strong position in the Bitcoin ETF market with total net inflows of over $30 billion since its launch. Fidelity’s FBTC ETF also performed well with inflows of $133.94 million, while ARK Invest 21Shares’ ARKB, and Bitwise’s BITB received smaller contributions.

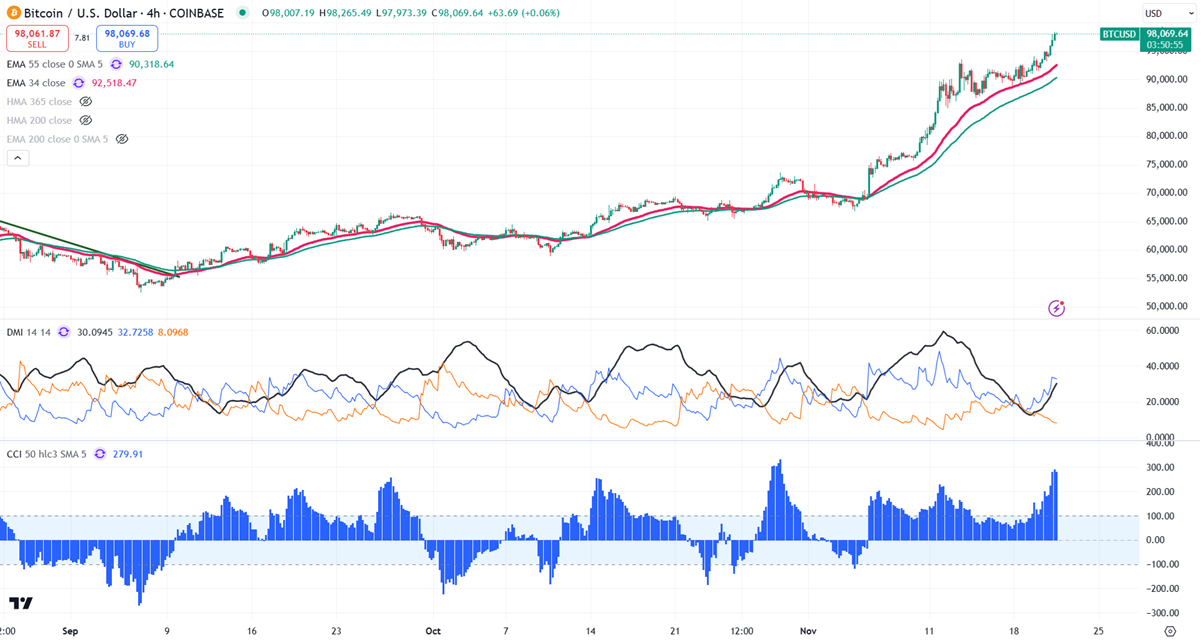

Technical Analysis and Price Levels

BTCUSD trades above the short-term moving averages (34-EMA and 55-EMA) and the long-term moving average (200-EMA) on the daily chart. Minor support is at $95,500; any break below this level will target 90,000/\86,000, $80,000, or $75,800.

Bullish Scenarios and Investment Strategy

In a bullish scenario, the primary supply zone is at $100,000. A break above this level would confirm intraday bullishness, with a potential jump to $110,000. A secondary barrier at $110,000 suggests that a close above this level could target $135,000. Indicators on the 4-hour chart, such as a bullish Commodity Channel Index (CCI) and Average Directional Movement Index, support this positive outlook.

An investment strategy could involve buying on dips around $90,000, with a stop-loss set around $84,000 for a target price of $135,000.

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate