Bank Indonesia is expected to hike its benchmark interest rate by 25 basis points at the unscheduled central bank meeting on Wednesday, May 30. Other measures to stabilize financial markets could also be announced, according to the latest report from ANZ Research.

New Bank Indonesia Governor Perry Warjiyo is looking to act decisively to stabilise the rupiah. With sound economic fundamentals and the rupiah undervalued following the recent sell-off, the new governor’s comments about getting ahead of the curve are expected to be positive for the currency, especially if backed up by a rate hike this week.

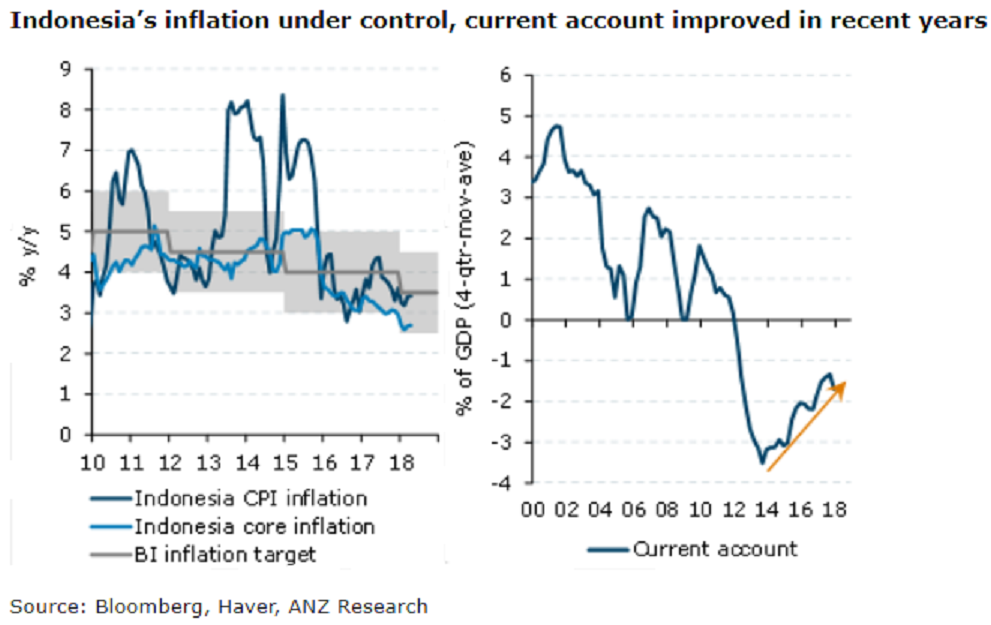

In response to the weakening of the rupiah, BI hiked interest rates at their May 17 meeting to 4.50 percent. The IDR remained under pressure despite that rate hike as the market did not view it as sufficient, especially when US 10-year bond yields moved above 3.1 percent.

"Therefore, we recommend selling 3M USD/IDR NDF at 14,179 (spot reference 14,006), targeting 13,800 with stop-loss at 14,350," the report added.

With new Governor Perry looking to take firmer action, there seems scope for a rebound in the domestic currency. Given the large portfolio outflows seen this year, there is scope for inflows to resume.

Meanwhile, the recent pullback in US 10-year bond yields below 3 percent and the retreat in oil prices, if sustained, will also improve appetite for EM assets. With Indonesia’s inflation well contained, further interest rate increases will make real interest rates in the country attractive for investors.

Lastly, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal

RBI Holds Repo Rate at 5.25% as India’s Growth Outlook Strengthens After U.S. Trade Deal  Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election

Asian Stocks Slip as Tech Rout Deepens, Japan Steadies Ahead of Election  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook  Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns

Japanese Pharmaceutical Stocks Slide as TrumpRx.gov Launch Sparks Market Concerns  Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness

Bank of Japan Signals Cautious Path Toward Further Rate Hikes Amid Yen Weakness  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks