As far as cryptocurrency goes, Bitcoin is arguably the most popular on the planet and also the most valuable. The process of getting these Bitcoins is called “Mining” and apparently, AMD’s Radeon graphics card units are incredibly useful for this task. As a result, the digital currency’s “Miners” are now buying up all of the Radeon GPUs, making them harder to find and more expensive.

In an email to CNBC, a spokesperson for the company said that the customers in the video game community are still the priorities of AMD. However, it seems the cryptocurrency market is also starting to represent a huge chunk of its GPU sales.

"The gaming market remains our priority. We are seeing solid demand for our Polaris-based offerings in the gaming and newly resurgent cryptocurrency mining markets based on the strong performance we are delivering," the email reads.

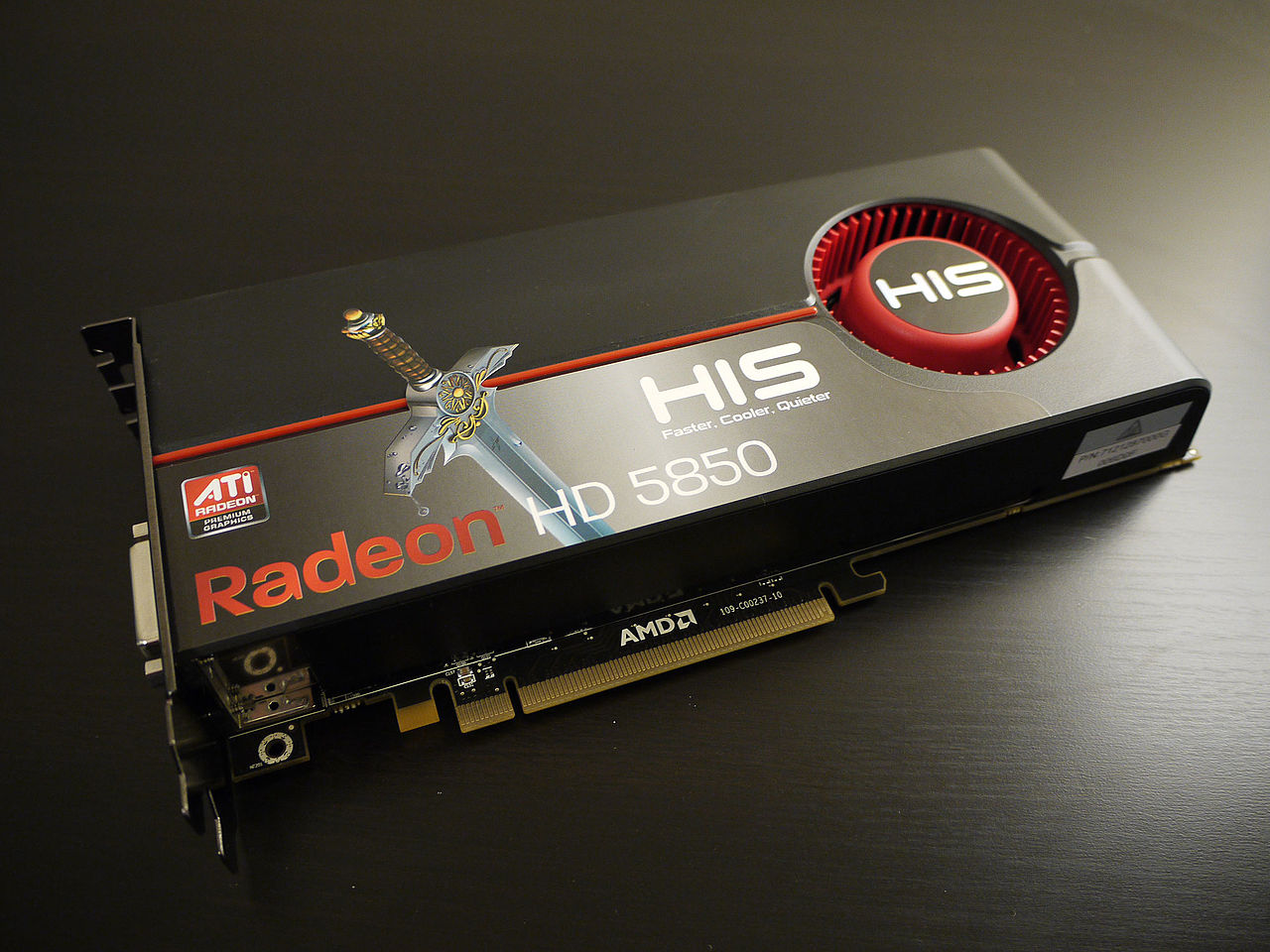

Although some miners are also using GPUs from Nvidia, it’s undeniable that AMD has a better reputation for the task. This is why AMD RX 570 and RX 580 GPUs in most retail stores and even online shops are sold out. Due to the scarcity of the cards, even older units are starting to surge in sales, proving that there is definitely high demand in the cryptocurrency market.

The trend has even caught on to auction sites such as eBay, where sellers are starting to put up used and new AMD GPUs. This is all having a good impact on the company’s bottom-line, but only time will tell if the trend will even last.

On that note, if the trend does go on, companies might just start developing GPUs that are specifically intended for cryptocurrency use, VentureBeat notes. This would create an industry-wide shift, where even processor chip makers like Intel will start developing their own products for the growing market.

Instagram Outage Disrupts Thousands of U.S. Users

Instagram Outage Disrupts Thousands of U.S. Users  AMD Shares Slide Despite Earnings Beat as Cautious Revenue Outlook Weighs on Stock

AMD Shares Slide Despite Earnings Beat as Cautious Revenue Outlook Weighs on Stock  Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine

Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine  Elon Musk’s SpaceX Acquires xAI in Historic Deal Uniting Space and Artificial Intelligence

Elon Musk’s SpaceX Acquires xAI in Historic Deal Uniting Space and Artificial Intelligence  Jensen Huang Urges Taiwan Suppliers to Boost AI Chip Production Amid Surging Demand

Jensen Huang Urges Taiwan Suppliers to Boost AI Chip Production Amid Surging Demand  SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates  Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026  Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised

Sony Q3 Profit Jumps on Gaming and Image Sensors, Full-Year Outlook Raised  Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch

Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports  OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering

OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering  SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off

SoftBank Shares Slide After Arm Earnings Miss Fuels Tech Stock Sell-Off  Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies

Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies  SoftBank and Intel Partner to Develop Next-Generation Memory Chips for AI Data Centers

SoftBank and Intel Partner to Develop Next-Generation Memory Chips for AI Data Centers  SpaceX Updates Starlink Privacy Policy to Allow AI Training as xAI Merger Talks and IPO Loom

SpaceX Updates Starlink Privacy Policy to Allow AI Training as xAI Merger Talks and IPO Loom