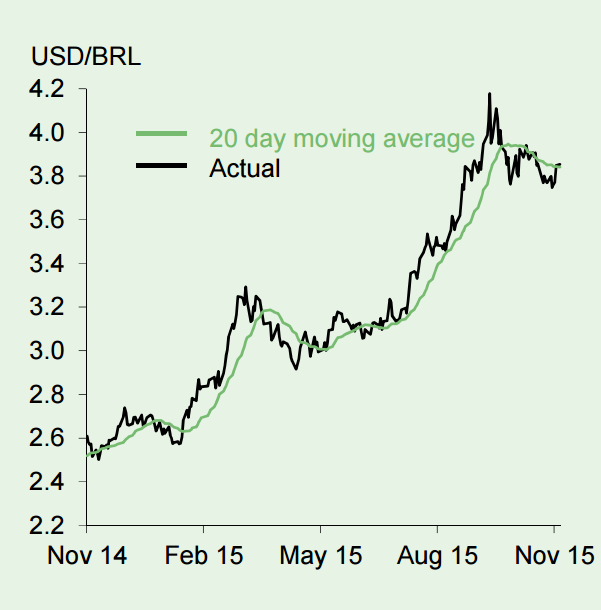

The Brazilian real was little changed against the USD over the past month, but still managed to retain its title of worst-performing EM currency this year. A break in USD/BRL above the September high of 4.24 against the USD cannot be ruled out. Brazil's economy is expected to contract by around 3% this year, with a further decline forecast for next year, hence weighing on tax revenues.

Yet, a further rise in interest rates would only further worsen prospects for the economy and fiscal sustainability. But without further policy tightening, the prospects are for a further depreciation of the Brazilian real and upward pressures on inflation. Clearly, the Brazilian economy is in a bind.

It would appear that the situation can only be resolved on a sustainable basis with a more fiscally austere government embarking on an ambitious fiscal consolidation programme. Failing that, the risk that pressure for capital outflows will build which would, without capital controls, result in an even sharper depreciation of the currency and a significant pickup in inflation.

Brazilian real Outlook

Thursday, November 19, 2015 2:23 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022