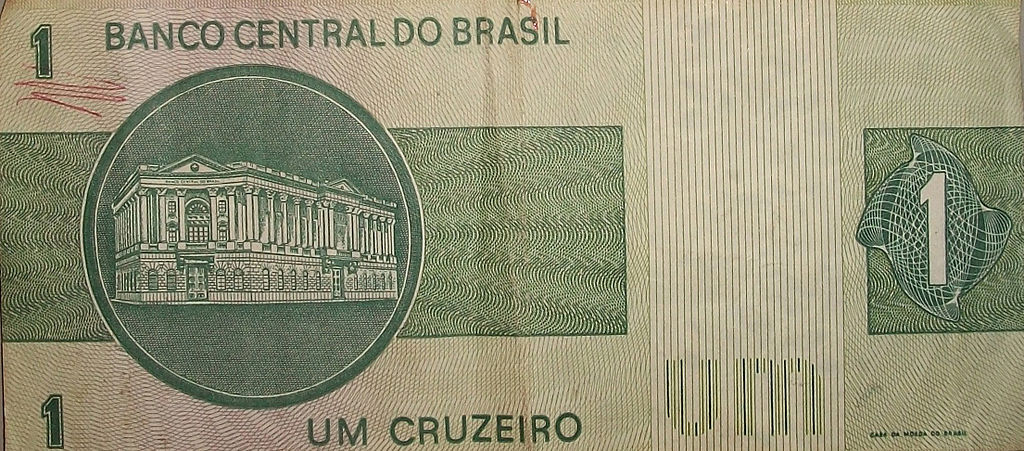

Brazil's central bank announced plans to conduct a $3 billion dollar auction with a repurchase agreement on Tuesday, aiming to roll over debt maturing on March 6. The auction will take place between 10:30 a.m. and 10:35 a.m. local time, with the repurchase set for October 2. This marks the third such auction by the central bank in 2025, reflecting ongoing efforts to manage Brazil's external debt obligations and stabilize the currency amid global economic uncertainties.

The auction underscores Brazil's strategy to maintain liquidity and ensure market confidence as the country navigates economic challenges. Dollar auctions with repurchase agreements are crucial tools for central banks, providing short-term funding while mitigating foreign exchange volatility. By rolling over debt, the central bank aims to ease market concerns over impending obligations and maintain financial stability.

The decision comes as emerging markets, including Brazil, face pressures from fluctuating global interest rates and currency depreciation risks. Analysts view this move as part of a broader strategy to defend the Brazilian real and manage the nation's foreign reserves effectively.

Market participants will closely monitor the auction results, which could impact Brazil's currency market and investor sentiment. The central bank's proactive approach highlights its commitment to addressing economic challenges while maintaining financial stability. Investors and analysts alike will assess how this auction influences Brazil's economic outlook, foreign exchange reserves, and debt management strategies.

With this auction, Brazil's central bank continues to play a pivotal role in the country's economic landscape, ensuring liquidity and fostering investor confidence in the face of global uncertainties.

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom

South Africa Eyes ECB Repo Lines as Inflation Eases and Rate Cuts Loom  BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan

BOJ Holds Interest Rates Steady, Upgrades Growth and Inflation Outlook for Japan  Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty

Bank of Canada Holds Interest Rate at 2.25% Amid Trade and Global Uncertainty  Hims & Hers Halts Compounded Semaglutide Pill After FDA Warning

Hims & Hers Halts Compounded Semaglutide Pill After FDA Warning  Washington Post Publisher Will Lewis Steps Down After Layoffs

Washington Post Publisher Will Lewis Steps Down After Layoffs  MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks

MAS Holds Monetary Policy Steady as Strong Growth Raises Inflation Risks  Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links

Tencent Shares Slide After WeChat Restricts YuanBao AI Promotional Links  Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains

Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains  SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO

SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO  OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering

OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering  Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million

Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices