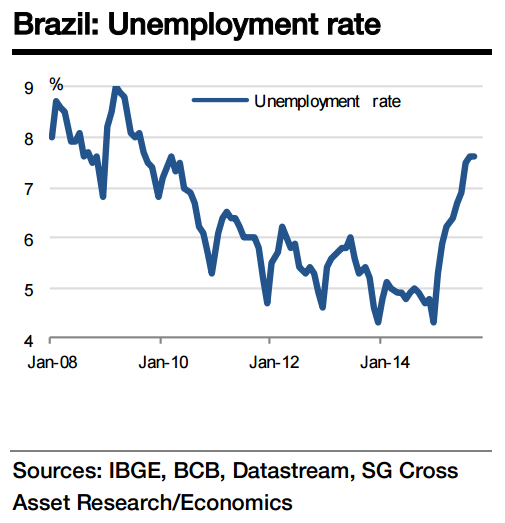

After increasing rapidly out to July, the unemployment rate did not rise much over the following two months (from 7.5% in July to 7.6% in August and September). However, estimates of seasonally adjusted labour data show the unemployment rate at only 7.2% in July, rising to 7.5% in August but staying unchanged in September.

The unemployment rate is expected to remain unchanged in October, assuming a 1.1% rise in the workforce and a slight acceleration in loss of employment (at -1.9% as against -1.8% in September). However, seasonally adjusted number still indicates continued labour market weakening leading to a rise in the unemployment rate from 7.5% in September to 7.7% in October.

The GDP contraction has led to a sharp deterioration in the labour market this year, with the unemployment rate rising to 7.6% in September from 4.3% in December 2014. Loss of employment at -1.8% yoy in September was the worst since record keeping began for this series in 2001.

At the moment, while the labour force is rising at an annual pace of roughly 1.1%, the pace of decline in employment accelerated from nearly -0.8% yoy early this year to -1.8% in September. With the economy in deep recession, there is a risk that the average unemployment rate this year could be much higher than the 2015 forecast of 6.5% (4.9% in 2014).

"We forecast 8.3% in 2016, and would be surprised if the unemployment rate does not top 9.5% by end-2016", says Societe Generale.

The rising unemployment rate should ultimately help cool wage growth to 5.0% this year and 3.3% next year, compared with 10.1% in 2014. While this would help moderate inflation expectations, it would also likely be a strong drag on private consumption and growth.

Brazil's unemployment likely unchanged in October, but up on seasonally adjusted basis

Wednesday, November 18, 2015 11:04 PM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX