Brexit has broad implications for every business niche, but gambling in the EU has traditionally been decided by sovereign member states, which puts this industry in a unique situation. For a heavily regulated industry such as iGaming, most Brexit challenges are related to the legal status of British territories such as Gibraltar and EU-based migrant workers in their offices. Technology companies located outside the UK could find it more challenging to reach their players and get licensing deals.

Additionally, the Gambling Commission is inclined to change long-standing policies depending on what kind of Brexit Boris Johnson’s parliament ends up enacting. Let’s explore all Brexit implications for iGaming in more detail.

How the iGaming Industry Enters the New Year

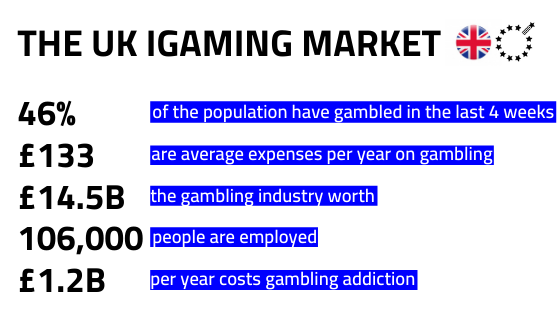

UK Gambling companies have been consolidating since 2016, in preparation for the upcoming wave of changes. It’s a giant industry with surveys showing gambling participation in the UK at around 46% of the population, with online gambling in particular steadily growing by 1-3% every year.

Tories were always ambivalent about gambling policies, paying lip service to the industry and its freedoms, but backing major regulations to restrict access to fixed betting terminals and the imposition of bet limits. Additionally, new money laundering regulations are leveraged on the use of crypto-assets and their role in potential money laundering schemes.

Corporate social responsibility is expected to keep guiding decisions across the industry. Major gambling companies participate in initiatives to reduce problem gambling and open their statistics to the public, which can hopefully lessen the impact of an industry transition.

Current Changes in the iGaming Industry

Plans for new regulations and stakes cuts on FOBTs to £2, as well as the 21% consumption tax already plunged the land-based gambling stocks. Once these same limits extend to online betting and gambling, websites and mobile apps will take a hit, some of them may not be ready for. And it wouldn’t be the last of their 2020 problems.

As of April of this new year, credit card use in online casinos and betting websites is prohibited. It is motivated by an earlier Gambling Commission survey in attempts to address gambling in debt. While a move is supported mainly by the public and major industry players, it has implications for iGaming specifically. Many betting portals will lose revenue due to increased payment commissions and the use of third party payment processing software.

Ten million people in Great Britain gamble online for real money, so the top UK free online slot machine games and poker machines are unlikely to lose popularity. The extension of credit card bans to poker machines, and penny slots will restrict at least 800,000 people from this payment method. Nevertheless, most enthusiastic gamers find ways how to play free and choose no download and no registration games to be not disclosed.

As mentioned earlier, new anti-money laundering regulations imposed on iGaming will have a similar effect on the industry, with processing and due diligence fees further increasing into the 2020s. VIP programs popular on gambling websites are also under Gambling Commission investigation, as participation in these schemes showed an increased affinity towards problem gambling.

In the long run, these changes are likely to favor established gambling firms over technology startups and new businesses – as they’re more likely to rely on loyalty programs and crypto-asset payments as primary sources of revenue. Impact of the new regulations on lessening problem gambling can still be worth the effort, with further Gambling Commission, reports to come later in the year.

License & Taxes

As it stands, the UK Gambling Tax stands at 15%, with sites netting the government over £2.7 billion every year. That’s unlikely to change with Brexit, as the EU has no control over state gambling policies, and Great Britain always had stricter laws than most other members. There are no standing agreements that impact iGaming or its licensing process.

The only possible reason for tax changes would be a very costly Brexit in a weak economy – potentially forcing the Tori government to rack up taxes on the «vices» such as smoking and gambling first before any others.

In terms of operations, EU-based companies might find it more difficult to extend their gambling licenses in the UK going into the 2020s. Additionally, the government released an 8-point list for Gambling workers in the UK, centered around confirming licenses of all employees and making the necessary changes to accounting and reporting.

One of the points is the need for having an EU representative for any business operating in both jurisdictions to avoid breaching requirements of either. Any companies that hold the hardware in the EU are expected to transport it into the UK after Brexit, already implying a big divide for companies that serve gamblers in multiple countries. Copyright laws are to be taken into account just the same, potentially requiring more legal resources.

Important to note that these particular requirements are in flux, and some are related to a No Deal Brexit, while others are universal. Any agreement between Johnson and the EU might change the picture.

The Future

Uncertainties of preparing for Brexit hurt the market much more than the event itself. Companies have to prepare for changes that may or may not be coming, which creates unpredictability and often leads to investment paralysis.

For example, global firm MaxEnt Ltd has already withdrawn its brands from the UK market, with its licenses revoked by the Gambling Commission and further appealed. They cited «strategic business reasons» as the cause for withdrawal. These kinds of situations can become more common as financial uncertainty piles up.

Because the size of gambling markets in the UK is over £18 billion, the newly elected conservative government could use this industry for a «cash boost» to amend potential Brexit costs across other industries more affected by the financial strain.

On a positive note, the iGaming industry already had to adapt to separate regulations across multiple borders. Once the initial impact of Brexit sets in, it’s predicted to continue operating as standard, with tax revenues and profit margins not undergoing a significant change. The exact situation depends on how the final Brexit deal looks like, so the factors cited in this article might matter more or less as a result.

This article does not necessarily reflect the opinions of the editors or management of EconoTimes.

Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies

Missouri Judge Dismisses Lawsuit Challenging Starbucks’ Diversity and Inclusion Policies  Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape

Trump Backs Nexstar–Tegna Merger Amid Shifting U.S. Media Landscape  Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains

Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains  Weight-Loss Drug Ads Take Over the Super Bowl as Pharma Embraces Direct-to-Consumer Marketing

Weight-Loss Drug Ads Take Over the Super Bowl as Pharma Embraces Direct-to-Consumer Marketing  Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil

Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil  Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch

Global PC Makers Eye Chinese Memory Chip Suppliers Amid Ongoing Supply Crunch  Instagram Outage Disrupts Thousands of U.S. Users

Instagram Outage Disrupts Thousands of U.S. Users  Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit

Uber Ordered to Pay $8.5 Million in Bellwether Sexual Assault Lawsuit  Ford and Geely Explore Strategic Manufacturing Partnership in Europe

Ford and Geely Explore Strategic Manufacturing Partnership in Europe  Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026

Baidu Approves $5 Billion Share Buyback and Plans First-Ever Dividend in 2026  SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates  Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate

Amazon Stock Rebounds After Earnings as $200B Capex Plan Sparks AI Spending Debate  Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine

Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine  TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans

TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment