When it comes to Brexit, biggest uncertainty is the legality or rather future of current trade deals. Britain currently has a free trade agreement (FTA) with European Union that helps it to cater to single market. Moreover it has trade deal with 60% of the world nations through European Union.

While Brexit optimists argue, Britain can get a better deal with rest of the world, exiting from EU, pro campaigners suggest it would be difficult to get a better deal with European Union.

Much has been said across financial media (including us), how getting an FTA with EU would be difficult for Britain once it exits the union. We guess, it is time we show the other side too.

Getting an FTA will not be in Britain's interest alone and that is a fact, and latest trade data released today shows why?

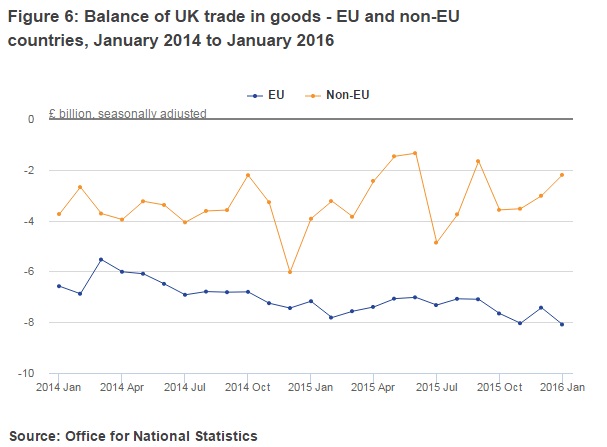

- According to Office of National Statistics (ONS), In January 2016, European Union registered a trade surplus of goods with United Kingdom in tune of £8.1 billion and in last three months, £23.5 billion. So, UK can be considered European Union's cash machine.

- To argue in favor of UK, its trade deficit in goods with rest of the world in January was -£2.2 billion, just about 25% of the amount with EU.

We don't think it will in EU's interest to impose tough trade rules that would face retaliation and kill the gold laying goose.

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions

Trump Endorses Japan’s Sanae Takaichi Ahead of Crucial Election Amid Market and China Tensions  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady

Fed Governor Lisa Cook Warns Inflation Risks Remain as Rates Stay Steady  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off

Dollar Steadies Ahead of ECB and BoE Decisions as Markets Turn Risk-Off  Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality

Trump’s Inflation Claims Clash With Voters’ Cost-of-Living Reality  India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out

India–U.S. Interim Trade Pact Cuts Auto Tariffs but Leaves Tesla Out  Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal

Trump Lifts 25% Tariff on Indian Goods in Strategic U.S.–India Trade and Energy Deal