South Korean brokerage houses have raised their target prices of Samsung Electronics Co. to as high as 90,000 won on signs of a recovery in global chip demand.

Kiwoom Securities Co. increased its target price of top-cap Samsung Electronics from 75,000 won to 90,000 won, while NH Investment & Securities Co. likewise upgraded its target price to 90,000 won from 76,000 won.

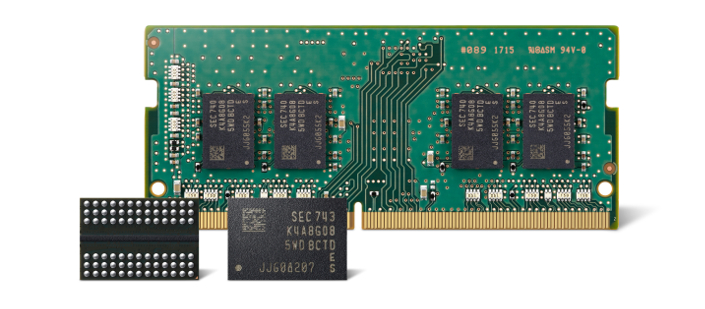

According to Kiwoom Securities analyst Park Yoo-ak, Samsung's fourth-quarter shipments of DRAM chips are expected to way exceed earlier estimates due to solid global DRAM demand.

Samsung Electronics' operating profit is seen ranging from 82 trillion won to 100 trillion won in 2022, depending on changes in DRAM demand.

According to NH Investment & Securities Co., there would be a slowdown in supply growth for DRAM couple by rising demand from data centers.

Nonetheless, most securities companies set their target prices on Samsung Electronics at 80,000 won.

Hyundai Motor Securities Co. raised its target price for Samsung Electronics from 74,000 won to 80,000 won due to a double-digit rise in server DRAM prices in the second quarter.

SK Securities Co. kept its target price for Samsung Electronics at 87,000 won, expecting the company's fourth-quarter profit to fall due to the won's surge against the US dollar, despite relatively good business conditions.

AMD Shares Slide Despite Earnings Beat as Cautious Revenue Outlook Weighs on Stock

AMD Shares Slide Despite Earnings Beat as Cautious Revenue Outlook Weighs on Stock  Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million

Once Upon a Farm Raises Nearly $198 Million in IPO, Valued at Over $724 Million  Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports

Nvidia, ByteDance, and the U.S.-China AI Chip Standoff Over H200 Exports  Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge

Nvidia CEO Jensen Huang Says AI Investment Boom Is Just Beginning as NVDA Shares Surge  Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains

Prudential Financial Reports Higher Q4 Profit on Strong Underwriting and Investment Gains  OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering

OpenAI Expands Enterprise AI Strategy With Major Hiring Push Ahead of New Business Offering  Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil

Toyota’s Surprise CEO Change Signals Strategic Shift Amid Global Auto Turmoil  SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates

SpaceX Prioritizes Moon Mission Before Mars as Starship Development Accelerates  TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment

TSMC Eyes 3nm Chip Production in Japan with $17 Billion Kumamoto Investment  Ford and Geely Explore Strategic Manufacturing Partnership in Europe

Ford and Geely Explore Strategic Manufacturing Partnership in Europe  Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns

Nintendo Shares Slide After Earnings Miss Raises Switch 2 Margin Concerns  Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies

Nvidia Nears $20 Billion OpenAI Investment as AI Funding Race Intensifies  Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine

Alphabet’s Massive AI Spending Surge Signals Confidence in Google’s Growth Engine  Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks

Rio Tinto Shares Hit Record High After Ending Glencore Merger Talks  Australian Scandium Project Backed by Richard Friedland Poised to Support U.S. Critical Minerals Stockpile

Australian Scandium Project Backed by Richard Friedland Poised to Support U.S. Critical Minerals Stockpile  SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO

SpaceX Pushes for Early Stock Index Inclusion Ahead of Potential Record-Breaking IPO  TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans

TrumpRx Website Launches to Offer Discounted Prescription Drugs for Cash-Paying Americans