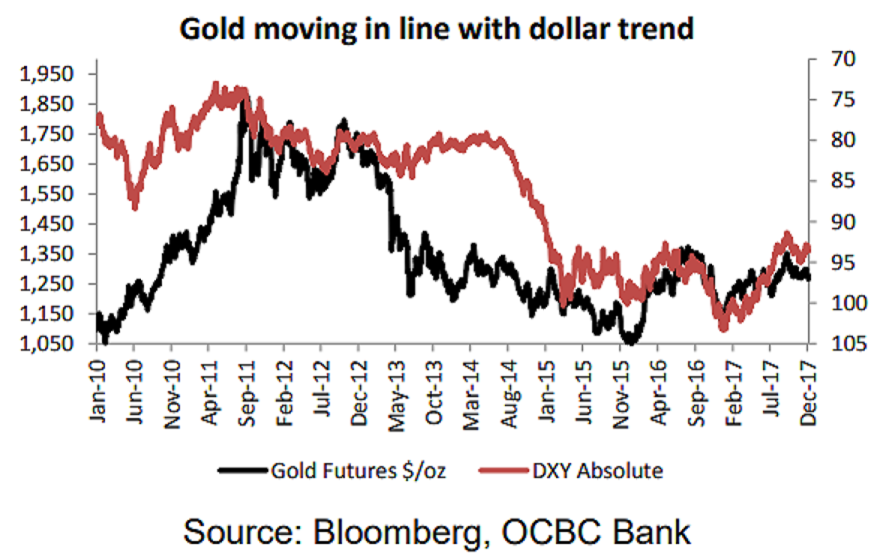

Bullion prices are expected to travel lower through this year, although a multi-faceted commodity it is, its status as a safe haven and a hedge against dollar weakness would weigh on the yellow metal’s performance, OCBC Bank reported.

The global economic outlook into 2018 should prove to be a rosy one; IMF tips global growth at 3.7 percent in 2018, a tat faster than an estimated 3.6 in 2017 according to their October WEO report. The recent FOMC dot-plot chart continues to suggest three more rate hikes next year (although the current futures curve is pricing in one to two more hikes instead). Global trade activities remain strong into end-2017.

As such, the uptick in risk appetite should necessitate yield-chasing behavior, while more rate hikes could bring about a more expensive greenback. Of course, upside risks to gold prices cannot be fully discounted; geopolitical tensions remain on the horizon, while uncertainties pertaining to US economic and trade policies could resurface into the next year. Moreover, higher food and oil prices may lift global inflationary pressures, in which gold could be a useful hedge against higher prices.

Given that the yellow metal is traditionally priced in US dollars, further strengthening of the dollar would result in fewer dollars (in nominal terms) needed to purchase the same ounce of gold. This results in a cheaper gold price as the dollar appreciates. Dollar value is largely driven by the strength of the US economy (as well as the prospect of Trump’s tax plan which is slated to cut corporate tax which in turn provide further support for growth) and higher domestic interest rates.

"We are likely to see another rosy global environment next year, which then underpins our bearish outlook for gold at USD1,100/oz into end-2018. However, should risk aversion intensify be it from geopolitical reasons, heightened inflation concerns, or from an unexpected slowdown in global growth momentum, the yellow metal may start to gain favor again," the report said.

Meanwhile, FxWirePro has launched Absolute Return Managed Program. For more details, visit http://www.fxwirepro.com/invest

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure

Oil Prices Slide on US-Iran Talks, Dollar Strength and Profit-Taking Pressure  South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks

South Korea’s Weak Won Struggles as Retail Investors Pour Money Into U.S. Stocks  U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains

U.S.-India Trade Framework Signals Major Shift in Tariffs, Energy, and Supply Chains  Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm

Japan Economy Poised for Q4 2025 Growth as Investment and Consumption Hold Firm  Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran

Trump Signs Executive Order Threatening 25% Tariffs on Countries Trading With Iran  Australia’s December Trade Surplus Expands but Falls Short of Expectations

Australia’s December Trade Surplus Expands but Falls Short of Expectations  Thailand Inflation Remains Negative for 10th Straight Month in January

Thailand Inflation Remains Negative for 10th Straight Month in January