Russia's central bank (the CBR) will announce its monetary policy decision this week. The key rate is likely to remain unchanged at 11% p.a. in line with consensus, as RUB volatility has increased (although bearably) on recent global and Chinese woes, which are negatively affecting commodity prices.

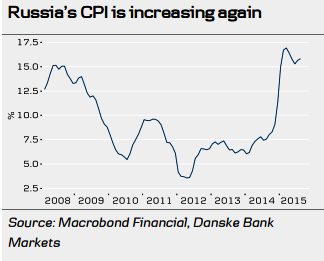

"At the same time, Russia's CPI increased on further RUB weakening, climbing to 15.8% y/y in August, from 15.6% y/y a month earlier. The CBR will refrain from rate cuts in September to keep the RUB market calm and be consistent with previously declared targets", says Danske bank.

The decision will be followed by a press conference and the quarterly monetary policy report, which will reveal possible changes in the CBR's stand. Yet, near term, similar hikes are not expected in the CPI to those seen early 2015.

CBR likely to keep key rate unchanged in 11 September meeting

Tuesday, September 8, 2015 4:06 AM UTC

Editor's Picks

- Market Data

Most Popular

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons

Why Trump’s new pick for Fed chair hit gold and silver markets – for good reasons  BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action

BOJ Policymakers Warn Weak Yen Could Fuel Inflation Risks and Delay Rate Action  Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic

Jerome Powell Attends Supreme Court Hearing on Trump Effort to Fire Fed Governor, Calling It Historic  China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices

China Extends Gold Buying Streak as Reserves Surge Despite Volatile Prices  BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook

BOJ Rate Decision in Focus as Yen Weakness and Inflation Shape Market Outlook