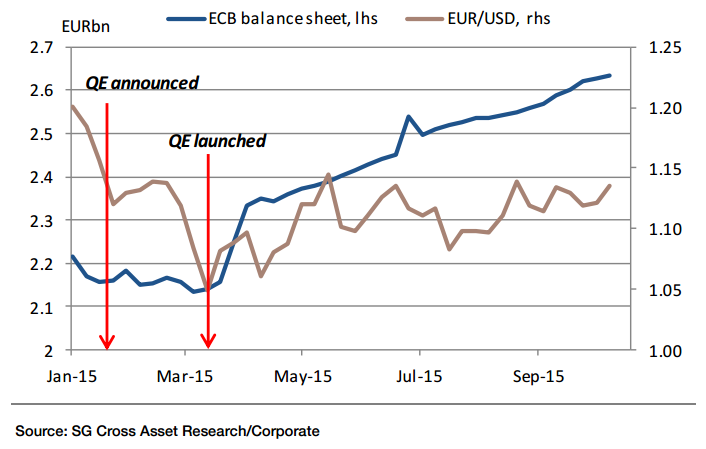

ECB's expansion of its balance sheet by close to €500bn over the past seven months has been unable to stop the euro from strengthening against all of its G10 and emerging market counterparts. The EUR has infact posted largest gains since March of 23% against the BRL, 15% against the COP and 10.5% against the AUD. This logic of a central bank boosting its balance sheet and a stronger currency turn economic logic on its head, raising the question - "What makes investors believe that QE2, an expanded purchase programme, could stop the euro from going up?"

Compared with the previous QE episodes in the US and Japan, the performance of the euro is particularly striking. When the Fed first embarked on QE in 2009, the USD lost nearly 22% in 12 months against the EUR and 13.5% against the JPY. And when the BoJ announced QQE in October 2014, JPY promptly shed over 12% against the USD over the following six weeks. EUR/USD on the other hand had touched a 2015 low of 1.0458 just one week after the ECB launched its QE in March, but has not revisited this level since, and instead has been on an upward trajectory.

Bursting of the equity market bubble in China, the fall in commodity prices and the exit from EM assets brought about an unbroken stretch of gains between June and September. The currency's resilience is a corollary of interest rate expectations in the US, as well as the malaise in emerging markets and lower commodity prices. The single currency's safe haven status has allowed the euro to thrive during the sell-off in equities and commodities. The euro, despite the ups and downs in Greece, has served this purpose better than any other currency.

"If the euro can't go down on the Volkswagen story, and the euro can't go down on the Greek story, it should be telling you something," said David Bloom, global head of FX research at HSBC.

The withering of US rate hike expectations has forced the ECB to come off the fence and prepare for an expansion of its existing QE programme. By raising the bond purchase limit from 25% to 33%, president Draghi at the September meeting effectively signalled that he is ready to act again. However, the intention to expand the balance sheet at a faster pace than the present €60bn per month probably won't have more than a knee-jerk impact. After a brief pullback to 1.1105, EUR/USD has gained just over 3% as now flirts with 1.1445.

But the longer the Fed waits to hike and the longer euro zone resident investors see the need to repatriate emerging market holdings back into euro, the higher the likelihood for EUR appreciation. Lowering rates again may be the central bank's most powerful option.

Earlier today, ECB governing council member Ewald Nowotny said that the ECB is missing its inflation target and will have to ramp up stimulus measures. Nowotny said that additional sets of instruments are necessary and added that these instruments should include both structural reforms as well as measures to stimulate demand. His comments mark the first time one of Europe's senior central bankers has all but confirmed more QE is coming. The single currency fell to $1.142 from $1.149 levels and is trading at $1.1441 as of 1005 GMT.

Can ECB's QE extension halt the euro's upward trajectory?

Thursday, October 15, 2015 10:29 AM UTC

Editor's Picks

- Market Data

Most Popular

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings  FxWirePro- Major Crypto levels and bias summary

FxWirePro- Major Crypto levels and bias summary