On the verge of economic data announcements in Euro zone as shown below, volatility in currency tend to go up given the tension in the market and readjusting of portfolios.

Important data releases for today: German retail sales, French Consumer spending, Spanish CPI, and Italian Q1 GDP.

The change in volatility before and after announcements expresses the change of mood in the market. Hence, we have to observe and use Vega in our strategy as it measures the sensitivity of an option's value to a change in volatility.

After the data release, it often drops and even more so if the data was as expected.

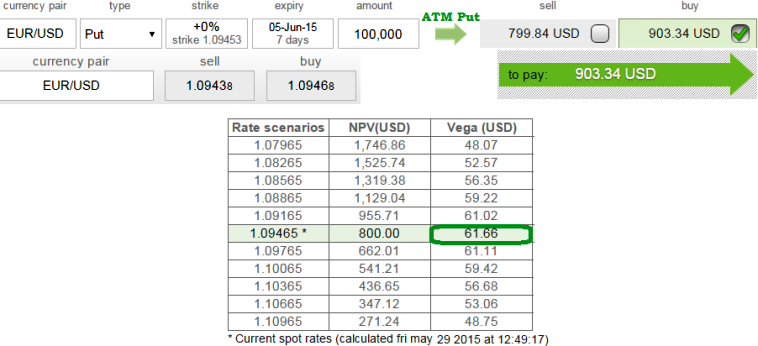

So if you expect EUR/USD to dip or remain range bound then you could look ahead to trade a long ATM with less Vega value naked put.

Here the put holder who has no desire to own the underlying currency as he expects it to slump in coming days.

The investor buys ATM put option with an anticipation that the price of the underlying currency will go significantly below the striking price before the expiration date.

As shown in the figure Vega at its highest value at 61.66 because the position contains ATM contracts. Any change in implied volatility adds change in option pricing.

Maximum Return = Unlimited

i.e. Total return = Strike Price of long put - premium paid.

Cautious about Vega on ATM Puts

Friday, May 29, 2015 7:31 AM UTC

Editor's Picks

- Market Data

Most Popular

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand

JPMorgan Lifts Gold Price Forecast to $6,300 by End-2026 on Strong Central Bank and Investor Demand