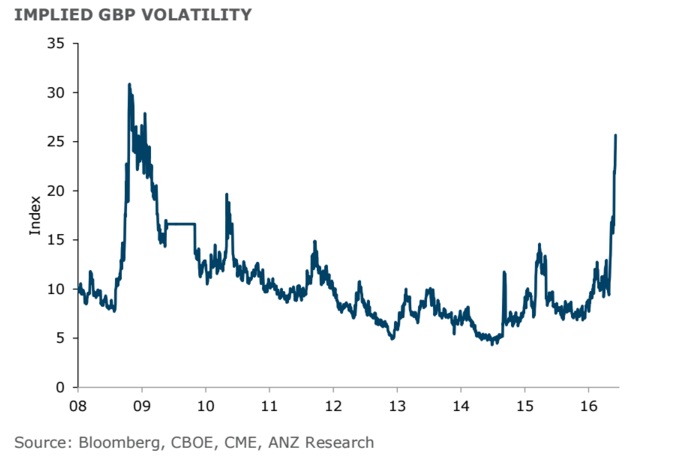

Implied volatility in 1-month sterling option soared to 23.7 percent, highest since 2008/09 crisis when it briefly crossed over 30 percent. Lack of insurers in primary markets leading to a run in the secondary market led by fear of Brexit.

Read more on Brexit, in our special Briferendum Series here - http://www.econotimes.com/topics/briferendum-series

Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022