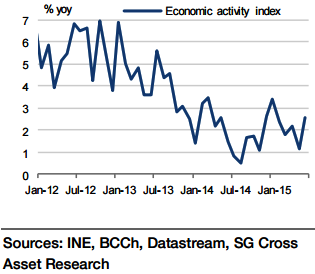

An uptick in June apart, Chile's economy grew by a sluggish 1.9% yoy in Q2, the slowest pace of growth in three quarters and down from 2.4% in Q1. Moreover, the economy actually stagnated on a sequential basis in Q2 vs growth of 1.0% qoq in Q1. Based on the trade and manufacturing numbers, we estimate that the economy likely grew at the modest pace of 1.9% in July.

"Based on the demand-side details in the Q2 GDP release, the economy is likely to grow by 2.3% in 2015. The main cause of 2015 growth downgrade is renewed weakness in private investment, as exports have failed to pick up. Also, the substantial rise in public spending and the stronger labour market failed to lift consumption growth in Q2", says Societe Generale.

As a result, with investment outlook remaining subdued in 2015, there is little hope for a meaningful pick-up in consumption demand over the medium term. On average, the economy is on a downtrend, as the key long-term growth drivers - investment and exports - both continue to struggle. Meanwhile, the positive contribution to growth from net exports is on the back of a significant decline in imports, another factor explaining the weakness in domestic demand growth.

In sum, growth is primarily surviving on counter-cyclical fiscal spending and - arithmetically - falling imports. Structurally, the economy is much weaker now than it was a couple of years ago.

"Growth potential has declined to less than 3.0% from more than 4.0%, and substantial fiscal and monetary easing will fail to restore the potential unless supported by positive external shocks. With the China factor continuing to play a big role on the external front, there is little reason for optimism in the medium term", added Societe Generale.

Chile growth likely moderated again in July on weaker trade numbers

Monday, September 7, 2015 6:49 AM UTC

Editor's Picks

- Market Data

Most Popular

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022