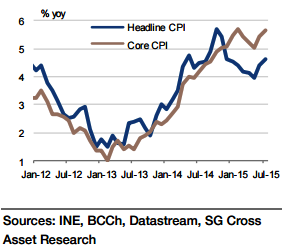

A fresh round of substantial peso depreciation has halted Chile inflation's brief phase of moderation. Also, the labour market has been tighter thanexpected despite below-trend growth for some time now.

"After the acceleration in July, headline inflation is expected to rise by one tick to 4.70% yoy (0.40% mom) in August. Given the prospect of further pressure on the currency, inflation could stay in the 4.0%-5.0% range this year, as against our previous view of it heading towards the BCCh's target by Q4", says Societe Generale.

While core inflation remains relatively high, a 0.3% mom change should bring core inflation down to 5.6% yoy.

"Therefore, inflation is forecasted at 4.4% and 3.6% for 2015 and 2016 from 3.8% and 3.1%. Having said that, peso depreciation alone might not be enough to exert sufficient upward pressure on inflation over the medium term", added Societe Generale.

The downside risks to the inflation forecasts relate to additional growth weakness leading to deterioration in the labour market and wages.

Chile inflation likely to rise by one tick in August

Tuesday, September 8, 2015 4:56 AM UTC

Editor's Picks

- Market Data

Most Popular

FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed