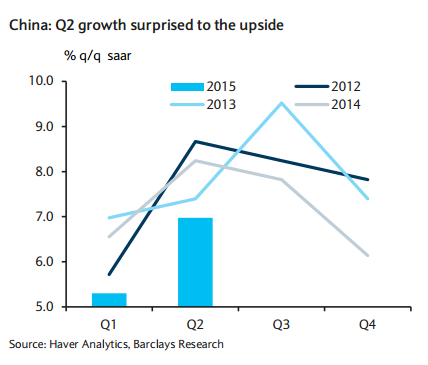

China's June data came in better than expected, with Q2 GDP growing 7.0% y/y, pointing to more signs of stabilization. Fixed asset investment (FAI) growth held up at 11.4% y/y YTD, supported by infrastructure investment, while the slowdown in property investment stabilized (4.6% y/y YTD). Retail sales growth recovered to 10.6% y/y from 10.1% in May. The data followed stronger trade activity, with export growth turning positive for the first time in Q2 and the contraction in imports narrowing. Industrial production growth rose to 6.8% y/y, the highest in H1 15 and up from 6.1% in May (Q1: 6.4%). The activity data were consistent with stronger-than-expected money growth and credit expansion, suggesting the earlier policy easing measures have started to take hold.

Barclays notes:

- We maintain our 2015 GDP growth forecast of 6.8% y/y and look for an "L-shaped" growth profile this year.

- We expect the overall macro policy mix to stay accommodative in H2 15, although the pace of broad-based monetary easing is likely to slow.

- We expect fiscal policy to be more expansionary, with increasing local government spending to support investment, particularly in infrastructure.

- Although recent stock market volatility has complicated monetary policy, we believe an easing bias will remain stay, given continued downside risks to growth and the expected large pipeline of local government debt issuance.

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed

Gold Prices Fall Amid Rate Jitters; Copper Steady as China Stimulus Eyed  Best Gold Stocks to Buy Now: AABB, GOLD, GDX

Best Gold Stocks to Buy Now: AABB, GOLD, GDX  FxWirePro: Daily Commodity Tracker - 21st March, 2022

FxWirePro: Daily Commodity Tracker - 21st March, 2022