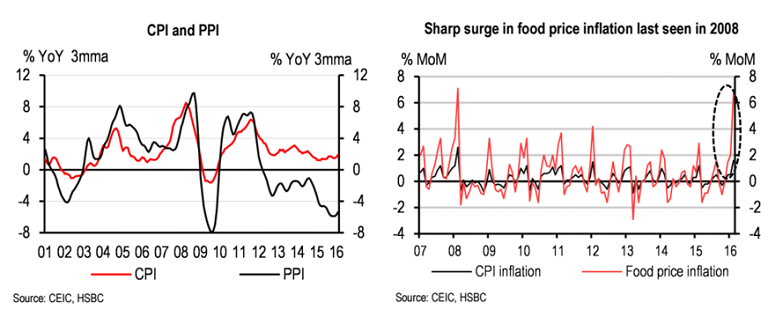

China's consumer price inflation rose 2.3 percent from a year ago, faster than January's 1.8 percent rise and well above Reuters expectations for 1.9 percent rise. The headline CPI inflation might continue to be relatively strong until food prices normalise, and this is unlikely to pose a constraint on PBoC's monetary policy.

Higher than expected food price inflation was the main contributor to the upside surprise in headline CPI inflation in February and likely only a temporary effect. The week-long Lunar New Year holiday that began on February 7 tends to increase demand for fresh food every year, which pushes up prices. Despite the surge, inflation isn't expected to continue accelerating.

"Part of the increase is due to Chinese New Year-related issues. Generally, the inflation picture overall is quite tame. For the whole year, we're still looking for inflation below 2 percent," said Grace Ng, economist at J.P Morgan.

Meanwhile, February producer prices tanked 4.9 percent on year, slower than January's 5.3 percent and in line with estimates. This marks the fourth consecutive year of Chinese firms slashing prices of their goods. PPI deflation squeezes cash flows in China's highly-leveraged corporates and impacts company profits and sales revenue.

"Against the backdrop of sluggish economic activities, we think the PBoC will likely persist with an accommodative monetary policy in order to support growth. We forecast further policy easing measures in the coming months." said HSBC Global in a report.

CPI data had no immediate effect on the yuan, while Asian markets were mixed following the data. MSCI's broadest index of Asia-Pacific shares outside Japan edged up 0.4 percent, however, volatile Shanghai stocks dropped 1.2 percent. The spot market yuan opened at 6.5158 per dollar and was trading at 6.5156 at midday, while the offshore yuan was trading 0.06 percent lower than the onshore spot at 6.5193 per dollar.

China CPI surge only temporary, PBoC's accommodative monetary policy likely to persist

Thursday, March 10, 2016 11:56 AM UTC

Editor's Picks

- Market Data

Most Popular

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?

BTC Flat at $89,300 Despite $1.02B ETF Exodus — Buy the Dip Toward $107K?  Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate

Elon Musk’s Empire: SpaceX, Tesla, and xAI Merger Talks Spark Investor Debate  Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings

Nasdaq Proposes Fast-Track Rule to Accelerate Index Inclusion for Major New Listings